Visualize Positions

I am a very visual person, and I need to see how things are plotted out on charts, and graphics to truly grasp what is going on. For this reason, I set out to create my own tools that can help me “see” what is going on from different perspectives. One regret I have is that I never made this tool with the forward thinking of making it universally available for others to login, and setup their own scenarios. If I ever do one day, you can be sure I will share it.

For the Dragons Eye Fund, now that I have a few positions setup, we can visualize it a little now, and see what it looks like in graphics rather than just numbers in a spreadsheet.

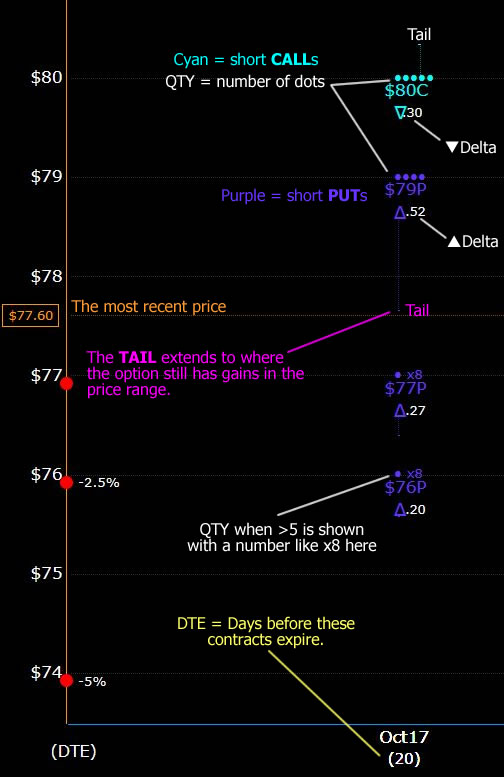

In this graphic I added a bunch of notes to help explain what each feature is. When it’s all visual like this, it is easier to recognize in just seconds all of the where, what, how much, etc.

Let’s go in depth as to what each detail means.

Short CALLs (bearish intentions) are cyan in color. Typically short calls are sold above the price a little ways, with the hope that the price doesn’t quite reach that level by th expiry date.

Short PUTs (bullish intentions), I show them in Purple.

In both cases, the number of dots, or a literal x8 or x7 etc will be shown above the price point. This helps me see in an instant if it’s a tiny, small, or larger position.

The TAIL is a small indicator that helps me see where the position turns into a loss. For example, the $79 Short PUTs have a tail that extends down to around $77.65 which means that even if the price doesn’t reach $79, there could still be some gains if it’s close to this range. Remember, with Short PUTs we want the price to be above the Strike Price. Even it it’s only a few pennies above, that can be a 100% gain. With short calls, it’s the opposite.

▲Delta (or ▼) this is the “greek” that shows how close to the “money” the option is. When this number is low, it sort of reflects the unlikeliness of the point being crossed. Ideally, I want these all to be near 0.01 when the expiry date comes, but that is very unlikely with a setup like this one.

Price is shown by a simple flat line across the page. We know that it won’t travel in this way to the end, but it give an indicator as to where the positions sit in relation to it.

Red Dots down the left give an indication of what drops of 1%, 2.5% and 5% would place the price at.

DTE is the days to expiration of these contracts where they either must be closed, rolled, or left to expire worthless.

Ideal Outcome

In this particular set of options, the most ideal outcome would be to see the price come to around $79.30 – $79.50 by October 17th. There is a lot of ground between here and there though. A lot of Tweets, a possible government shut down, tariff announcements and other possible headwinds or tailwinds to making that happen.

There’s another tool I use to think about calculations when I am initially setting them up, and it’s good old Excel spreadsheets. Here’s a link to an article on how I use Excel to both setup, and follow up when desired on positions.

If you download the excel sheet, you can edit and tweak the numbers yourself.

Related Posts

Milestone Dec31

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several