After all was said and done on Friday July 25 the results so far are pretty satisfying. I knew when I started trading TSLA that it would be a dumpster fire, in fact, I posted an image on my FB account the day I began coverage and trading on it with the caption “TSLA – This is the perfect time to start trading this POS”

I didn’t know then what was about to occur with stock price nor do I know now. I was simply attracted by the sheer volatility and controversy that you could cut with a knife. It was going through trials by fire, literally in some places in the US, and turmoil that I don’t think we’ve ever seen before. The volatility numbers translate into insane valuations on the options related to TSLA stock, and that’s what I am really interested in. I am not a fan-boy of Elon Musk, but I do recognize his abilities when he sets his focus to things. I don’t think that TSLA and Space-X could be where they are without him, and neither do hundreds of analysts.

I didn’t know then what was about to occur with stock price nor do I know now. I was simply attracted by the sheer volatility and controversy that you could cut with a knife. It was going through trials by fire, literally in some places in the US, and turmoil that I don’t think we’ve ever seen before. The volatility numbers translate into insane valuations on the options related to TSLA stock, and that’s what I am really interested in. I am not a fan-boy of Elon Musk, but I do recognize his abilities when he sets his focus to things. I don’t think that TSLA and Space-X could be where they are without him, and neither do hundreds of analysts.

Thursday as I pointed out in the first blog after earnings was a huge disappointment, and while Fridays bounce back still leaves TSLA at over 5% down from it’s weekly high, it was significant enough to help me twerk out of some long biased positions with gains, and setup another set of options for next week that contain some guaranteed wins.

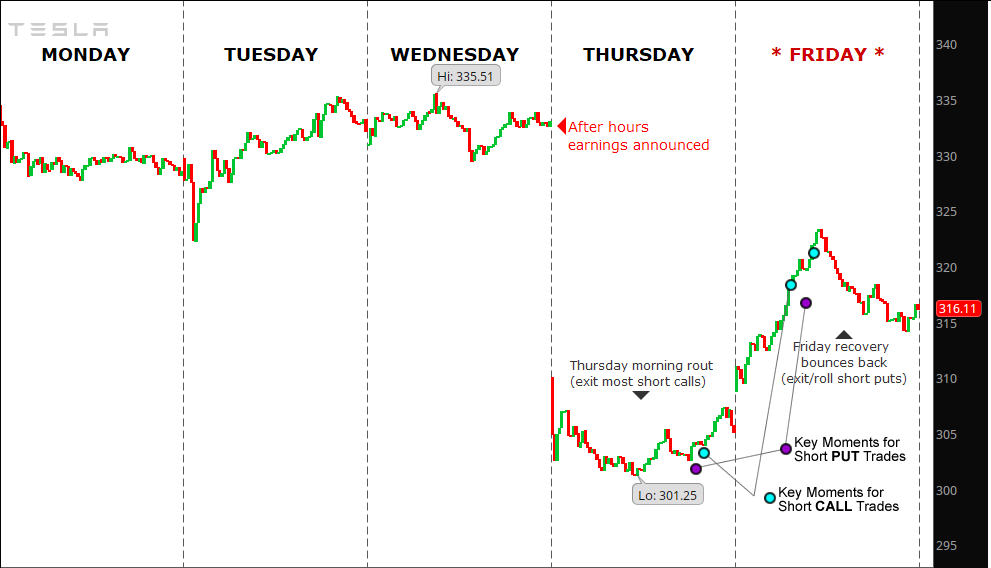

Here’s a visual of the action.

I apologize to the small screen users who have to pinch and zoom on this. I pointed out some key moments on the chart from an options trader point of view. On Thursday with the plunge, the mind set has to focus on the mantra of what is done on down days. I have these phrases that go through my mind whenever there is a significant shift, and no matter where my positions are, I have to think these phrases.

“What do we do on Red Days?”

“We buy or close short calls, and sell or hold short puts”

That’s why on Thursday, even though it cost a few hundred dollars to close, I took the opportunity to close all my excess short calls on TSLA, and basically ring the register on those. At the same time, I had a few short puts that got into a lot of pressure, and so I had to hold on to them, and even roll some of them 1 week forward just so that I wouldn’t get assigned (forced to buy shares) on those contracts. The good news is, rolling produces a cash-credit, it just kicks the can down the road to another date for responsibility.

Now, fast forward a little to Friday, and we notice that there is a rebound. I anticipated this rebound, and even vocalized this opinion to my co-worker while it was happening live on Thursday. My exact words were “There’s a lot of people who want out of TSLA, they are selling hard, and that’s pressuring this price downward. Once those people exhaust what they’re trying to sell, the price will go back up. It may not go up as high as it was on Wednesday, but it will rebound some.”

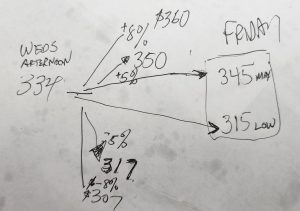

On Weds, I had written on a piece of potato chip stained paper my high and low prediction for Friday’s close. At that time, I felt that the low would not be less than $314 and that the high couldn’t be higher than $345. I actually piled on more short calls at $350 because my gut said that this was going to be a downside surprise, not an upside. A close of $316.11 vindicated me in a huge way.

On Weds, I had written on a piece of potato chip stained paper my high and low prediction for Friday’s close. At that time, I felt that the low would not be less than $314 and that the high couldn’t be higher than $345. I actually piled on more short calls at $350 because my gut said that this was going to be a downside surprise, not an upside. A close of $316.11 vindicated me in a huge way.

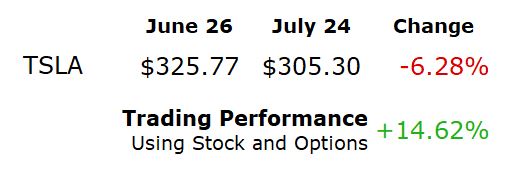

Yesterdays performance graphic showed that since I began coverage, TSLA has been down 6.28% while my performance was +8.5. After todays bounce back, these numbers change significantly.

Yesterdays performance graphic showed that since I began coverage, TSLA has been down 6.28% while my performance was +8.5. After todays bounce back, these numbers change significantly.

This is now a 1 Month number as it’s been 31 days (as of the weekend) since trading began. I am not sure if I have been able to notch a number this high after one month on my other favorite stocks, but I feel this has only just begun. I will continue the short strangle on this “behemoth” and see if I can choke some more gains out in the weeks to come.

TSLA – Earnings Week

July 23 after the market closed Elon Musk and Vaibhav Taneja (CFO) engaged in a conference call that I actually tuned in on. I don’t often do that, but I had the opportunity, and I thought it might be interesting to listen in. Elon sounded like he may have taken one too many pills, and …

<a href="https://www.optionslinky.com/tsla-earnings-week/"

TSLA

Tesla as an investment is something I have always avoided. I never thought that it was worth the price, and honestly, I still don’t. I think the stock as a car maker is grossly over valued, the CEO is erratic, his political ties with Donald Trump cause nothing but mayhem, the investor base is largely …

<a href="https://www.optionslinky.com/tsla/"