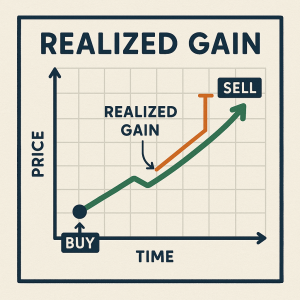

REALIZED GAINS

When you have completed the cycle of buying, then selling any instrument whether that be a stock, option, piece of land, or a bicycle, the resulting gain or loss can be referred to as your “realized gains.“ With our investment portfolio, these can accumulate over time across several stock symbols, several days, weeks, months etc. This is how we know if we have made successful trades or not.

If you buy something for $200 and then sell it for $300, you would say you have a “realized gain” of $100. This is because all parts of the transaction are complete. The acquisition, and the disposition. The net result forms part of your performance with this instrument.

If you buy something for $200 and then sell it for $300, you would say you have a “realized gain” of $100. This is because all parts of the transaction are complete. The acquisition, and the disposition. The net result forms part of your performance with this instrument.

How about if you paid $400 for something, and then sold it for $350? Then you’d be faced with a “realized loss” of $50.

Hopefully, the accumulation of closed transactions will result in an accumulation of Net Realized Gains. Now unless you’re running a hedge fund that is meant to run against another fund with a completely opposite objective, you should always want to make sure that your gains outnumber your losses. Eventually you occasionally have to take a hit on some of your trades, especially if you’re directly hedging one position against another. It’s common, and acceptable that one of those moves will take a loss, but it’s designed as such to allow the other position to take the win.

Once you make a trade to close a position, it is no longer part of the bag and the transaction now is part of your history of “realized gains” which sometimes I will abbreviate, and refer to as RG. Over time, you will be logging gains and losses over and over. There can be periods where you are logging complete winners, no losses at all. This is great, but in my experience, and in the patterns that happen with the strategies I employ, it’s likely to end at some point, and some losses will creep into the log again. If we start to see the losses outnumber the gains, then we have to seriously take a look and see if our strategy is flawed for the current market environment, and make adjustments.

Milestone Dec31

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be