PUT OPTION CONTRACT

With a PUT option contract, the buyer is paying a premium to own a contract that aims to profit if the stock price should fall.

With a PUT option contract, the buyer is paying a premium to own a contract that aims to profit if the stock price should fall.

It doesn’t necessarily have to fall below the strike price that has been agreed upon, because as long as the stock price falls during the time frame of the contract, the buyer could profit from his purchase.

The seller of the PUT contract is receiving money to take on the obligation that he may have to buy shares of that stock if the price were to go below the strike price. Essentially, the seller is making an assertion that the stock price will remain in a range above the strike price of the contract. The seller can be profitable even if the price does drop below the target, as long as it’s not below the target plus the premium received.

PUT CONTRACT EXAMPLE

In this example we have the following elements:

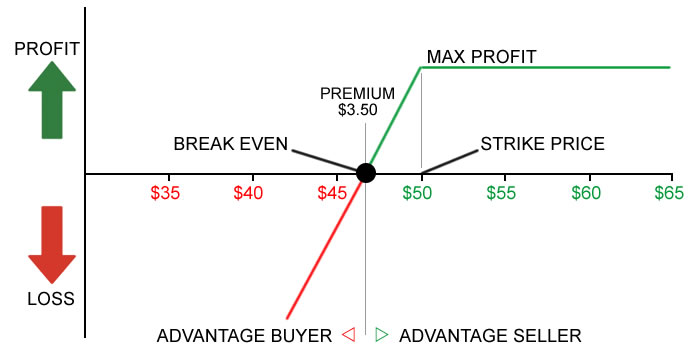

STRIKE PRICE: $50

PREMIUM: $3.50

We are only focusing on the expiry point and where the profit and loss would be for both the buyer, and the seller. In this example, $3.50 was paid for the option, that ends up being $350 because it’s representing 100 shares. Should the price be above the strike price of $50, then the SELLER realizes maximum profit. The seller can also see profit if the price is below $50, but still above $46.50 because the premium received still counts as part of the profit or loss.

The BUYER on the other hand does not make any profit unless the stock price is below $46.50 because the buyer first paid $3.50 for the PUT contract. For it to be of any profit value, the price must drop below the point where it will generate profit.

KEY CONSIDERATIONS

The buyer is in effect paying for the chance to win. If the buyer is wrong, there is no plan B. It is only money lost on the option. This may be ok, as the purchase could have been an “insurance” against losing, or other valid reason for the buyer, but in the end, the buyer must be better than 100% right in order to profit at expiry.

The seller has to be close to being right to be able to profit, and also has a plan B if things do not work out. Although one may say it’s digging a deeper hole, ROLLING the option to a future date allows the seller to recover whatever loss may be in this instance, and receive a credit to extend the time frame of the contract with a new buyer. That topic can be covered in a different post.

Related Posts

Compare Results Week 4

Compare Results – AMZN Week 4 June 7th, 2025 After 4 weeks here are the results so far. (From May 15th to June 6th is

Dragons Eye

Dragons Eye Strategy Welcome to the landing page for the Dragons Eye Strategy. This is a project aimed at creating an income fund with the

Dragons Eye Prospectus

Dragons Eye Prospectus September 21, 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye.