Progress Oct4

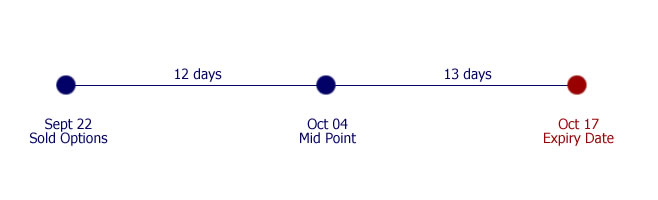

With roughly 50% of the time expired on our first leg of the journey, it’s a good time to check our progress. First of all, just visualize a timeline for a moment because it’s important to be able to grasp where we are in time with relation to our open option contracts. Sometimes we might consider doing something early, but it comes down to whether the opportunity or need is greater than our ability to be patient.

Oct 4th, 2025

Today is Saturday, so the data is as of the end of the day Friday. Looking at the timeline, we’re pretty much right in the middle. By Monday when the market opens again, we will be closer to the “finish line” than we were to the start. This of course is only the first milestone in what we hope to be a long and not so winding road. Now lets take a look at the data. For this part we don’t need a chart, we just need to look at how the options are performing, and how much of that original “premium” we were paid does it look like we’re going to keep.

I also would like to introduce some concepts to think of the different options as if they were “The Investment” and “The Insurance Policy” This will help newcomers to options understand how short options can act like things we are very well aware of in our day to day life.

The Investment

First of all, lets look at the 20 short PUT options as the “Investment.” This is because short PUT contracts are a synthetic way to take a long position in a stock, or buying stock you might say. So when the price of a stock goes up, the investment appreciates in value. If the price of the stock goes down, then it loses value just as it would if you owned that stock. This is the simple part of things really. Take note of the size of the LONG side, 20 contracts in total. I went lighter at the $79 level because that was going to be the hardest level to reach when I was looking at this on Sept21, and I had more confidence that $76 and $77 could be reached so I went heavier on those contracts. Where is the price today? It’s at $78.73, so it’s very close to the top end of our “investment” block of options. Still, nothing is a sure thing, especially with the fragile nature of how things can be in the world, and that’s why there is an “insurance” component in this plan as well. We will come back to break down each of the three sections of the investment block, but first lets take a quick look at how the “insurance policy” works.

Insurance Policy

Short calls are a tool for several purposes, in this strategy, they serve as a small insurance policy. However, when this policy was put in place, I didn’t “buy” it. Nothing was paid for it. Instead, I took on some risk that would have an insurance payout if certain conditions were met, and would have a cost to me under different conditions. Lets take a look at those, and determine if this insurance policy was a good idea or not. I will try not to make the explanation as long as a real insurance policy!

If SPLG remains above $79 and below $80, which is the price of the CALL contract, the insurance policy will pay out 100%. All 20 PUT contracts will be 100% gains, and all 5 CALL contracts will also be 100% gains. I used my whatif excel sheet to verify this, but with experience it’s just a given.

Now if SPLG is below $80, and also below $79, then we will have 100% gains on the Insurance Policy, but our gains on the PUT contracts at $79 will be a little less than 100%.

What happens if SPLG is above $80? Then the insurance policy begins to have a cost to it. The good part is that obviously if the price of SPLG is above $80, then all 20 PUT contracts were 100% gainers. How much cost will the insurance policy have? It will incrementally depend on just how high the S&P500 rose to in the next 2 weeks. If it’s a spectacular rise, then the insurance policy will have a greater cost. Lets imagine that it goes to $82 which is a pretty big reach, but within imagination limits. How much within imagination? Well that would be a 4.2% increase in 2 weeks. annualized that’s about 116%. To me, not very likely, but still possible if you must accept pure possible numbers. If that were to happen, the insurance policy would then have a net cost of $788, leaving us still with overall gains on this milestone of Oct17 of $597. Is that acceptable? To me it is, I mean, if SPLG hits $82, can you imagine what that would do to all the other investments held in other strategies? Yeah, there we go.

Let’s go back a little and look at the 3 legs of the LONG side, or the “Investment” part of the strategy.

First look at the $76.00 P x 8 contract. There are 8 of them, and the current delta is at 0.1344▲. The gain is shown as $190.69 and the Mkt Val, which is what it would cost to pay to close this contract is at -$140. This means the contract is now profitable to the tune of about 57%. The delta being so close to zero means it’s less and less likely that this is going to be a problem. If I look this up on the option charting tools part of ThinkorSwim, there’s an 86% probability that this ends up being a 100% gain.

How about the 77.00 P x 8 contracts? If you check the numbers, it’s also around 56% gain. The delta is a tiny bit higher, but still approaching zero. ThinkorSwim has the probability that this ends at 0 are 79%.

Where there is still a little work to do is on the $79.00 P x 4 contracts. This one is not quite half way yet, and that’s why the insurance policy is even put in place. It’s the final little push that helps this 4-Pack of short puts get nudged over the finish line. If that doesn’t happen, then the insurance policy will pay out a little, and possibly make up for the shortfall. Now you are likely starting to see why this contract price only has 4 contracts, and the others had 8. My willingness to risk the $79 level wasn’t as high as the $77 and $76 levels.

How are things overall?

It’s much too early to try to take a big read on how the overall strategy is doing since it’s only about 13 days old. Having said that, things are in positive territory. There is an overall position gain of about $1643, which is 0.8%. Again, that is only after 13 days, and we should not try to be getting any sort of read on things so early in the process.

The next important time to look at things is the last few days prior to Oct17. At that time there may be reasons to act early, or possibly there could be some reasons I am forced to act early. Until then, we just be patient, and let thetaΘ do it’s job.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"