Oct17$79 Assignment

Just like the title says, I’m going to show how to handle the assignment of the options that I sold back in September. Now I knew they had a slightly better than 52% chance that this would happen, so it’s not a huge surprise, nor is it a shock that is worrisome. It just comes with a decision to be made.

Option One (no pun intended) is to simply pay to buy back these options, then sell another set further out in time. This option would generate about $380 in net credit to the account if I picked November.

Option Two would be to allow the market to assign me these shares. This means I still keep all the premium that was paid back on Sept 22nd to me, but I also have to fulfill the contract by purchasing 4 contracts, which is 400 shares at $79 per share.

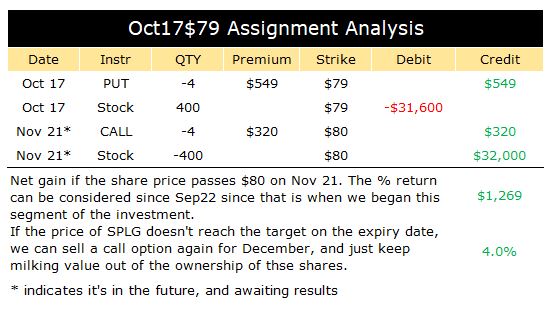

After considering several different calculations, I decided to go with the second option. Here’s a graphic to help understand why.

The first two lines are already done now. The $549 in premium was received back on Sep 22nd. The shares are now bought for $79 x 400 = $31,600.

November 21

The goal is to sell those shares on Nov21 for $80, and for that we’re going to post a SHORT CALL contract x 4 to do so. In this case now, we’re not actually SHORT. We’re COVERED. The term for this is called “Covered Calls” which means we have the shares to cover our short position. So we look out in time to November 21, and try to make a sale for these calls. I can either do this right away here on Oct 17th, maybe because I am unsure that next week won’t be uglier than this week, and we won’t get a good price. If I think next week should improve, then maybe I wait a few days prior to selling the short calls.

We have to let this brew for a month before knowing how it worked out. There are other things to do with this weeks expiry cycle, but this particular part stands out because it ended ITM, In the Money. So next time I use that term, ITM you will know what the impending consequences of it might mean. It doesn’t always mean I will handle it in the same way because there are other circumstances which could influence whether I roll out, or take assignment. When that day comes, we will discuss it.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"