June 10th, 2025 – AMZN

Amazon got quite a boost Monday, and has created both challenges, and opportunities for this week.

First, the challenges. Since I have several SHORT CALLS in place, some are now below the actual price of the stock. This of course could lead to me selling the stock at the price on those contracts. However, since I am not really ready to do that, I will have to maneuver things a little to avoid being “called away” on my shares.

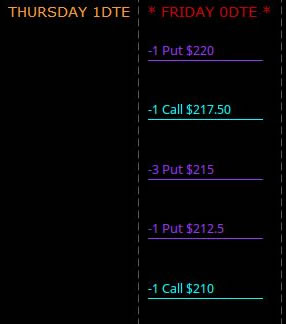

Here is the image for the week. For those on phones, you’re going to have to zoom and pinch a bit to be able to see this properly. I will cut and crop for sections of it later in the post.

$210 SHORT CALL AT RISK

Even though it’s still a few days away, today it’s defined as 3TE, this call needs to be watched closely. Now, the risk is not really all that great unless I am worried about tax implications from the gains selling. Let me say that if you’re so worried about tax implications on every trade, it’s like wearing ankle weights and trying to run. Sure, we want to be tax smart, but if we ONLY govern our portfolio by trying not to pay taxes, then in the end, maybe we get our wish because we end up not making enough to worry about paying taxes. I will ramble about that in another post one day, for now, that’s enough.

The call will get “assigned” and I would be “called away” on 100 shares if the extrinsic value of that contract gets so low that the person holding the other side of it just can’t resist exercising his right to those shares.

Right now it’s not looking that likely, but if the price of AMZN keeps pressuring the upside, then it becomes more likely. I haven’t discovered just how close that number can be yet on AMZN, but it’s sitting at about $0.50 this morning. I would probably let that drift into about $0.20 before I make a reactive move on this. When I do, it will be to buy the contract back at a loss, but then immediately sell a new contract that will cover the cost of the debit paid.

QUICK LOOK BACK

Let’s take a quick look back just because it’s on the initial image so that we balance the worry over having to pay for closing call contracts with something else.

Note that I had two LOSERS for last week. Those losers had some small costs to be able to ROLL them forward. However, the gains from all the contracts on the other side, the purple SHORT PUTS, was 7 x more than the losses on the call side.

I know it would be nice to score on every single shot taken, but I have learned to accept that the setups will sometimes lose on one side, but gain on the other. This is why I always try to balance the long and short delta so that no matter what happens, there will be gains.

For the FRIDAY expiration, I have a real dogs breakfast setup that would be easy for the “professional traders” to criticize. There is a method to this madness however, and it took me years to recognize it. I had to learn through trials and tribulations what happens if there are mega spikes, or huge drop offs? There are consequences, and I had to learn how to battle them. In the end, I feel it’s worth it as long as you have the patience and time, and resource to back up when you’re completely wrong.

THIS WEEKS MACRO DATA

This week has very important core inflation, PPI, and consumer sentiment data that will push things around a lot. My job will be to capture what I can during the swings, and try not to react excessively to one direction or the other until opportunity, or necessity present themselves. Here is the link to the website www.tradingview.com/economic-calendar where I check out important macro data that can affect markets. You can customize it a little, and there’s a pay version. I just use the free data for now.

WHAT’S NEXT?

For now, just be patient, watch and see if AMZN pulls back in line with previous trends, or tries to break out. As Friday approaches, the moves will become clearer, but wild swings can make those decisions look foolish after the fact.

The decision I am eyeing up right now is to add a short CALL at the top of that stack at $220 to form a short straddle at that price. I don’t honestly see AMZN maintaining a price above $220 through Friday, and if it does, that will be wonderful.

Related Posts

Milestone Dec31

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several