Dragons Eye Moves

Newest moves are on top, older moves and setup are lower down the timeline.

Oct 16th, 2025

On the eve of cycle expiry, two of the remaining groups of options are OTM (out of the money) which is what we want. One set of options is ITM (In The Money) which was somewhat expected as it had a 52.6% chance of ending up here, and well, the ITM Probability today says 100% right now, although there’s still a chance it escapes tomorrow. I don’t think so, and I think it might be assigned.

I will cover the handling of the assignment in a separate post here. So you can follow along how the mechanics of that work, and how to profit from it. I will have to free up some cash so that the account can buy it, but I will do that tomorrow near the end of the day when it’s obvious whether it’s only the $79×4 group of options that get assigned, or if I have to worry about the $77×8 group too.

Oct 10th, 2025

Presidents Trump and Xi of China literally began crashing the market with their tweets and messages regarding international trade. The value of the short calls dropped very quickly, and I saw this as an opportunity to capture some credit early. The following SHORT CALL options were closed on the 10th, expecting a chance in the future to sell them once again. The reasoning on closing these short calls is that they had served their purpose for a bit of insurance, but the value remaining was little, and it made more sense to close for gain now, and wait for a surge in the market (if we get one) to sell again.

Oct17$80Call – bought back for $0.05 – Gain: $187

Nov21$81Call – bought back for $0.35 – Gain: $59

Nov21$82Call – bought back for $0.20 – Gain: $47

Jan16$81Call – bought back for $1.26 – Gain: $101

Jan16$82Call – bought back for $0.90 – Gain: $86

On Oct14 I resold the Oct17 Calls, then closed them one day prior to Oct17 expiry.

Oct17$79Call – bought back for $0.06 – Gain: $31

Sep 26th, 2025

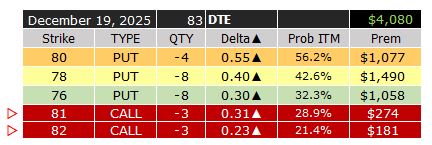

There was quite a bounce back in the overall market, and since I still had some room to complete positions for December, I thought today might be a good day to place the short call side of the scenario on. It’s not an absolute perfect time, but I might not get that perfect day, so I decided to add some short side insurance now. Here’s the two moves identified by the red arrows. This expanded the total premium received for December 19 from $3,625 to $4,080.

Does this mean it’s all “income” for December? Absolutely NOT! We have to always consider that these options all have a calculation when we get to the end, here’s a page to check out my “What If Scenario” calculator I use to create my setups.

Sep 23rd, 2025

In the early morning, I wanted to add some pieces I like to think of as “Insurance” to offset the positions held. These are SHORT CALLS which are considered BEARISH positions against SPLG.

Taking a short position, out of the money a short distance from the bullish short puts, is sort of like taking out an insurance policy against the base positions.

In this case, selling 5 short calls at $80 is effectively saying, if the price rises above $80, ALL of the short CSPs will be 100% successful, and I will deal with the consequences of being SHORT 5 calls at $80.

For now, I will leave the explanation at that. HOPEFULLY we end up in that situation, where the “insurance” is activated so I can show you how I deal with that, and turn the “loss” of that singular event, into a huge win.

Here is the updated positions list after taking several short calls on, not too many, as the thesis of this position is to be mostly bullish to the S&P500. The positions are now at the max that the portfolio will allow, other than maybe adding some more short calls for November/December, which could happen, but for now I think the positions are set, and we will be waiting for a few weeks to pass, and as we get close to October 17th, when some actions will become necessary.

Sep 22nd, 2025

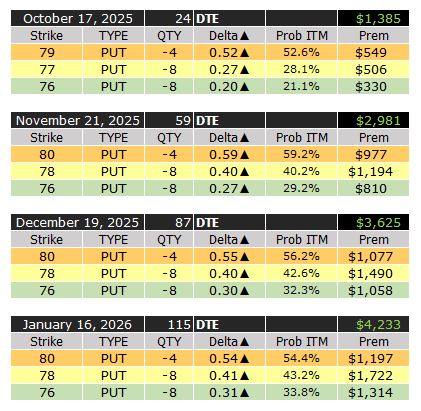

When the market opened on Monday September 22nd, it felt like it was a good opportunity to “get in” with this strategy that I’d been planning out. The morning is always a bit hot when it comes to option pricing, so this is to my advantage if I also get the direction right. This is especially true on the leading expiry cycle, which in this case is October 17, now only 24 days away.

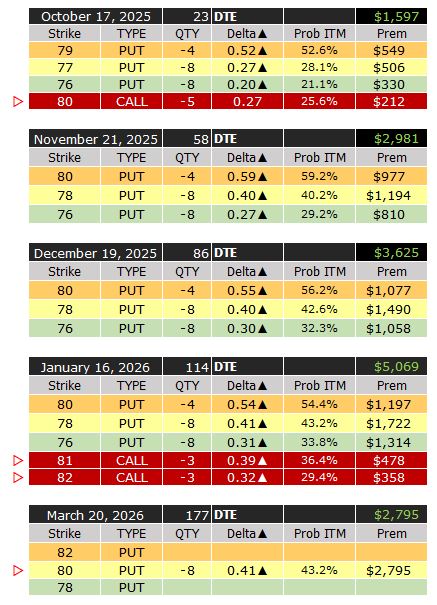

Here are the positions setup for the next 4 months. There are some more moves pending.

The orange colored lines are the higher priced targets, and I have them showing a bit of heat because they’re the hardest targets to be ahead of for the CSPs (Cash Secured Puts) to overcome to be 100% profitable. As the price goes down into the $77 and $76 ranges, it’s an easier level to foresee the S&P being above by those dates.

There is a little bonus in the action from yesterday as the total premium received for taking on this “risk” provided the ability to buy 122 more units of our “risk free” base SGOV and those will add about $1.20 per day of interest income.

Tomorrow I plan on adding a SHORT CALL component, which is a “bearish” notion. This will be used to take on some “insurance” against the position that can provide some income in the event the goals are not met in their target months.

Sep 22nd, 2025

When the market opens on Monday, I will give it some time to settle, and aim to begin selling options on the Oct 17th expiry first. This is only 25DTE (days to expiry). Then I will look to Nov 21st which is 60DTE and setup a few options there. After this, I will think about future months and decide what to do.

| October 17, 2025 | ||||||

|---|---|---|---|---|---|---|

| Short Put Options (Bullish, similar to buying stock) | ||||||

| QTY | Strike | ▲ | Price | Premium | Extrinsic | ITM Risk |

| 8 | 76 | 0.20 | 0.42 | 330.69 | 0.34 | 21.1 |

| 8 | 77 | 0.27 | 0.64 | 506.69 | 0.64 | 28.1 |

| 4 | 78 | 0.52 | 1.38 | 549.35 | 0.88 | 52.6 |

| Short Call Options (Bearish, similar to shorting stock) | ||||||

| QTY | Strike | ▼ | Price | Premium | Extrinsic | ITM Risk |

| 6 | 80 | 0.26 | ||||

Sep 19th, 2025

Sell all the accumulated bits of purchases I had been making with VOO. This had a return of 2.95% in only 1 month. That’s great, but I want to have this account focus on a balanced income growth strategy, and so the starting point for Sep 22nd next week shall be $201,184. This is what future reporting and benchmark tests will be based upon.

Before the end of the day, I used the entire balance to purchase SGOV. This “base” will now start to earn about 4% per year, however we are going to be constantly reinvesting the distributions from this, so likely the return can be compounded a little bit. More on that On October 1st.

Sep 19th, 2025

I transferred enough to reach $200K in this account from a long term fund that was previously earning around 10% per year, but with interest rate reductions the last 12 months or so, has dropped to a performance of about 8%. The goal is to create a fund that will generate 10% or more.

Aug 20th to 28th, 2025

With each deposit, I didn’t have enough to execute any significant trades, so I just deposited into VOO, a total market fund to allow some possible appreciation.

Aug 20th, 2025

I setup the account with Schwab around August 6th. It takes a while to verify identity and approve documents and tax jurisdiction etc.

On August 20th I began funding the account with small deposits that I could just to get things started. I’ve included even the smallest of details to show that it’s not just a matter of clicking on a page and getting started with no obstacles at all.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"