Dragons Eye ’26

This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options.

Part of it is comparable to what is known as an “iron butterfly” which is a limited-risk, limited-profit strategy designed to profit when the underlying stock price is expected to remain stable and have low volatility. I changed the name a bit, because I will be using underlying positions that do have some volatility, and I have added elements that will introduce a little bit of “fire”.

I decided on “Dragons Eye” because while this creature will indeed fly, and there will be elements of fire breathing mayhem, we view the wings of the dragon as representing it’s risk aspects. The body of the dragon is indeed very strong, and while the ability to breathe fire is the fuel behind the income, we have to accept that there are calculable risks in the wings of the dragon to know about.

Step One

To create the base of the strategy first we must commit the cash balance of the account to an ETF (Exchange Traded Fund) known as “SGOV” to provide the first aspect of steady income. This cash substitute will earn us the first 4% of income on the fund.

You can read more below about some specifics of SGOV and how it works. In this real-time project / tutorial we’re started with $200,000. To keep the wings of the dragon more agile, we had to trim that position to close to $100,000 in October. There are to be no contributions of our own unless conditions change where it is either an emergency, or another unknown factor enters the realm of possibilities.

Now that this is done, we will expect a daily increase in value to this aspect of the account of approximately $10/day for now, this will grow. I know this doesn’t sound like much, but it will add up over time, and it’s $10 more than you get just for holding a cash balance in your account. This instrument is “as good as cash” in the sense that it has an almost zero risk of anything happening to it short of a global nuclear war, “so you’re saying there’s a chance” – Lloyd Christmas.

Step Two

We are going to use option contracts for SPY to generate additional income for the fund. This aspect of the strategy can be thought of as one of the “wings” that ultimately control where the dragon can fly. For this we will use a fund that tracks the performance of the S&P 500. Over time, the S&P 500 has a continuing upward trend that from time to time will have pullbacks due to economic stress, hard times, or financial events that cause severe volatility in the market. The reason those risks even exist is what creates the possibility of income for stocks and options. The whole “it could go up, but it could go down” reality means that there will always be buyers and sellers of all the companies that go into the S&P 500.

This “wing” is the BULLISH side of the strategy, and so we’re going sell PUT contracts which is a bullish action. When you sell a PUT contract, you are taking on the attitude that the stock will stay above the target price you’re going to choose. In this strategy we’re going to be choosing prices for contracts, known as “STRIKES” that are somewhat conservative because we don’t really want to actually “buy” these shares, we just want bullish exposure to the movement of the S&P 500.

4 Month Timeframe

We will be aiming to sell our PUT Contracts for a 4 month cycle, and as one month expires, we will be looking to the end of the timeframe and add contracts to the 4th month forward. This will be a continual action based on the principles of the Slinky concept that I have been testing and perfecting for years. The expiry dates for monthly options appears to always be the last Friday of the month and a Friday mid to late month that is added to the listings when it’s approximately 3 months away. If that Friday is a day when the market is closed due to a holiday, it will be moved to Thursday in most cases.

Selecting Strikes

I use a long term projection model that I made to choose the option levels to sell on.

▲ DELTA

The options we select will use the ▲Delta indicator as a bit of a guide. There will be times when we choose ▲Deltas that are deeper into the money, or shallow, further away from the money. This will depend on our judgement at the time, and the decisions we have in front of us to make at the given time. To read just a little bit more about delta, follow this link: ▲Delta.

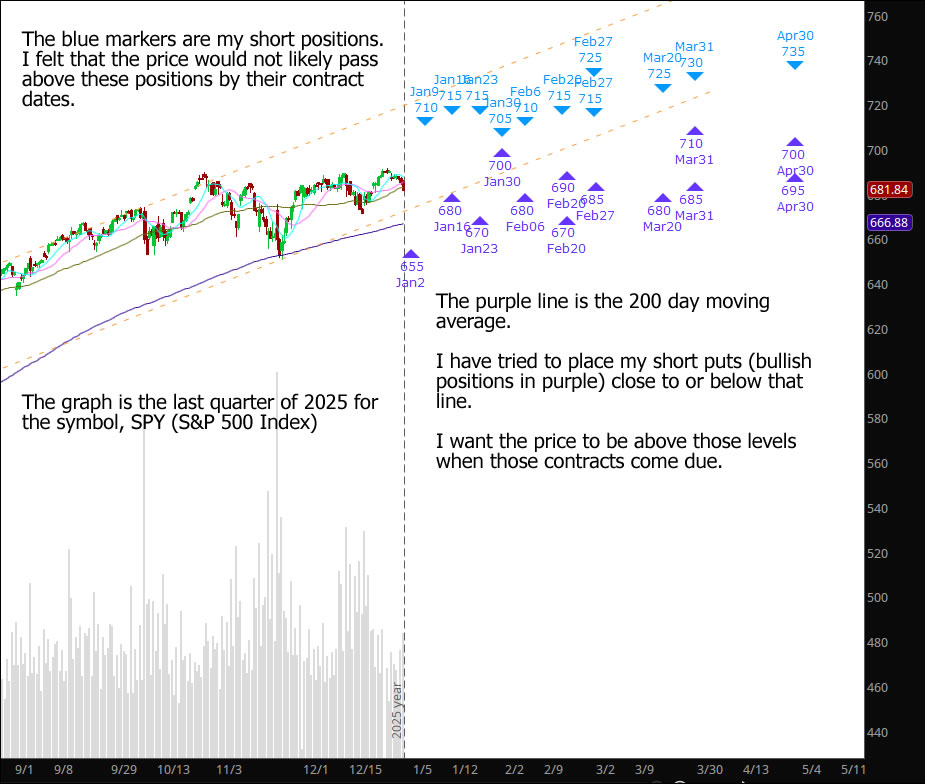

For now, we’re going to look to the end of the 4 month cycle and do some speculating with January to April options. This image is a simple chart with some notes I added on it. It’s not meant to be a prediction, I don’t have a crystal ball, nor am I able to predict where the market will go, but I have to have some sort of thesis, and this is it.

Selecting Strikes Continued

Now that this has been in practice for a few months, I have been able to improve a little on my strike selection. Some are a little too close to the lines for comfort, but as those dates come due, I will be making adjustments.

What if I am assigned?

This is a real world possibility, and it just means I must make good on my word to buy some shares of the SPY S&P500 fund. This actually happened to me on Dec19th. I didn’t move a couple contracts in time, and they got “assigned to me” and I ended up with 200 shares of SPY that I didn’t want to keep in inventory.

What I did the next trading day was sell them at a loss, and reopen the contracts for March and April. My net position didn’t really change much, it was just a matter of shuffling things around to get them where they were before, but on different dates. There was no need for panic, no interest was paid to make the purchase, and all ended calmly on that 3 day span.

Now I know the tolerance level of a short put contract, and can act accordingly going forward.

Explanation of how SGOV works.

Key Characteristics:

Distributions: SGOV pays monthly distributions to its investors.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"

Milestone Oct31

Milestone Oct31 40 days into this strategy, and this milestone is taking some measurements at the end of the month, October 31st. A few things have taken place, one completely expected, and the others, more significant, and somewhat unexpected. SGOV – The cash alternative First of all, the body of the dragon, the slow and …

<a href="https://www.optionslinky.com/milestone-oct31/"