Dragons Eye Strategy

This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options.

Part of it is comparable to what is known as an “iron butterfly” which is a limited-risk, limited-profit strategy designed to profit when the underlying stock price is expected to remain stable and have low volatility. I changed the name a bit, because I will be using an underlying stock that does have some volatility, and I have added elements that will introduce a little bit of “fire”.

I decided on “Dragons Eye” because while this creature will indeed fly, and there will be elements of fire breathing mayhem, we view the wings of the dragon as representing it’s risk aspects. The body of the dragon is indeed very strong, and while the ability to breathe fire is the fuel behind the income, we have to accept that there are calculable risks in the wings of the dragon to know about.

Step One

To create the base of the strategy first we must commit the entire cash balance of the account to an ETF (Exchange Traded Fund) known as “SGOV” to provide the first aspect of steady income. This cash substitute will earn us the first 4% of income on the fund.

You can read more below about some specifics of SGOV and how it works. In this real-time project / tutorial we’re going to invest $200,000 to begin with, and not make any contributions of our own unless conditions change where it is either an emergency, or another unknown factor enters the realm of possibilities.

Now that this is done, we will expect a daily increase in value to this aspect of the account of approximately $20/day for now, this will grow. I know this doesn’t sound like much, but it will add up over time, and it’s $20 more than you get just for holding a cash balance in your account. This instrument is “as good as cash” in the sense that it has an almost zero risk of anything happening to it short of a global nuclear war, “so you’re saying there’s a chance” – Lloyd Christmas

Step Two

We are going to use option contracts for SPLG to generate additional income for the fund. This aspect of the strategy can be thought of as one of the “wings” that ultimately control where the dragon can fly. For this we will use a fund that tracks the performance of the S&P 500. Over time, the S&P 500 has a continuing upward trend that from time to time will have pullbacks due to economic stress, hard times, or financial events that cause severe volatility in the market. The reason those risks even exist is what creates the possibility of income for stocks and options. The whole “it could go up, but it could go down” reality means that there will always be buyers and sellers of all the companies that go into the S&P 500.

This “wing” is the BULLISH side of the strategy, and so we’re going sell PUT contracts which is a bullish action. When you sell a PUT contract, you are taking on the attitude that the stock will stay above the target price you’re going to choose. In this strategy we’re going to be choosing prices for contracts, known as “STRIKES” that are somewhat conservative because we don’t really want to actually “buy” these shares, we just want bullish exposure to the movement of the S&P 500.

4 Month Timeframe

We will be aiming to sell our PUT Contracts for a 4 month cycle, and as one month expires, we will be looking to the end of the timeframe and add contracts to the 4th month forward. This will be a continual action based on the principles of the Slinky concept that I have been testing and perfecting for years. The expiry date for monthly options is always the third Friday of the month. If that Friday is a day when the market is closed due to a holiday, it will be moved to Thursday in most cases. At this point in time, our expiry dates are therefore, October 17th, November 21, December 19th and January 16th.

Selecting Strikes

For October, the expiration date is only 27 days away, so there is not going to be much meat on these bones, but we will still choose some strikes for that expiration date. For January however, there are option expiries that provide some more meaningful income. As we’re just getting started, the power behind this concept will not be seen at first until time has passed, and things begin to roll along a little bit. One of the dangers of beginning this strategy right now, in this moment, is that we are currently sitting at “All Time Highs” in the market. This will always exist, but it must be recognized because if there is a pullback, this strategy will immediately look like a failure, just like buying a stock at the top of a peak will look just days after buying it. Later on, you will read about how we will try to hedge that risk a little bit, but this fund is mostly an upward looking direction, and so it won’t have the same aspects of risk, and shorting that I have had on other individual stocks.

▲ DELTA

The options we select will use the ▲Delta indicator as a bit of a guide. There will be times when we choose ▲Deltas that are deeper into the money, or shallow, further away from the money. This will depend on our judgement at the time, and the decisions we have in front of us to make at the given time. To read just a little bit more about delta, follow this link: ▲Delta.

For now, we’re going to look to the end of the 4 month cycle and do some speculating with January options. This image is a simple chart with some notes I added on it. It’s not meant to be a prediction, I don’t have a crystal ball, nor am I able to predict where the market will go.

These channels and points of data just come from looking at what the options market is calculating right at this moment. It could change at any time, but this is what I am going to use to get started.

Selecting Strikes Continued

For my first contracts I want to sell, I will look to the top right corner of the chart and think about these a little bit. You can see the price as of Sep19th for this ETF was $78.30. Looking ahead to January, I plotted some prices and their corresponding deltas. An optimistic price of $84 which would be a continuing uptrend, has a delta of 0.81 and according to the options tool in Think or Swim, this has a 77% probability of NOT being passed, meaning it will be ITM (in the money), and likely assigned. I don’t know if I want too much of that option, so I look down a bit and consider the one at $82. This has a delta of 0.74, and the possibility of it being ITM is 70%. This might still be too much for me at this moment, so I will continue to look a bit lower.

If I consider $80, which is only about 2% above where we are in the S&P500 market as of Friday’s close, this might be a reasonable target for the higher end of my focus. Now, I am not saying the market can’t grow more than 2% from now until January, all I am trying to do is assess my risk on this matter, and consider whether I would enter a contract that is aimed at “buying SPLG at $80” should that price point not be reached. It is a 57% probability that I may have to be responsible to buy on that date, which is now a percentage I am willing to consider. Let’s dig deeper.

$80 PUT Contract for January 16th

Option Premium: $2.95 (estimated)

Delta: ▲0.57 and a 57% probability of ITM.

Extrinsic Value: $1.25

This new piece of terminology “Extrinsic Value” is a very important factor for me. This option has a “time value” or ThetaΘ total value of $1.25, which when contracted is x 100 so it’s value is $125 dollars of value just for the decay of time.

Let’s take a look at the actual trade ticket on ToS and see what it looks like, and dissect it completely.

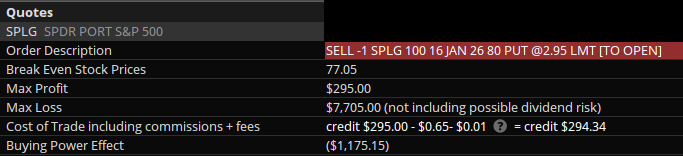

This is an actual screen shot of a trade ticket (not yet executed because I am writing this on Saturday and the market is closed). Lets take each aspect of the trade ticket and explain what it means to the person making the trade.

Order Description: This is a quick explanation of what the actual contract is. I am selling 1 contact of SPLG for January 16th 2026 at $2.95. The part that says “to open” means that I am opening the contract at this time, and thus I will be the person responsible for fulfilling that contract should the conditions be met on or before Jan16th whereby the other person wishes to execute their rights as the buyer.

Break Even Stock Prices: This is the price at the close of all of this process where I would still be at a $0 breakeven despite not passing $80. So this means, I can be profitable even if the price doesn’t get above $77.05 by January. That’s not a bad prospect considering it’s already above $78 today.

Max Profit: $295.00 is the most I can make on this contract, the buyer could make more under certain curcumstances, but I as the seller max out at $294.34 once you consider the .65 commission.

Max Loss: This number is a bit of an exaggeration, because it assumes that if the S&P 500 went to absolute $0, then I could lose $7705. I suppose that’s possible, but is it likely? Don’t let this number scare you. What it really means is this; If the price doesn’t stay above at least $77.05, I could have to buy 100 shares of SPLG at $80 which would cost $8000. This minus the premium received is a net cost of $7,705. This is also not an undesirable consequence, and therefore, I am willing to enter this contract based on that specification as well.

Cost of Trade: This means I will be receiving a net credit of $294.34 if I can sell this contract at $2.95.

Buying Power Effect: This is a figure that represents how much the brokerage will calculate my overall responsibility based on the value of this trade. If I execute this trade, then they will deduct this amount from my remaining activity power. $1,175 is not very much, when you consider that if I were to BUY 100 shares of SPLG, it would reduce my buying power by $4,000. (I got that from testing a trade ticket for “buying 100 SPLG for $80)

That’s one example of many that I will be setting up. The distribution of contracts will be such that some have risks like this one, of about 45% to 50% of being ITM, to lower risk contracts aimed at 25% to 35%. The idea is to have a wide coverage of price ranges that allow for monthly income, while maintaining a certain “safety” against being assigned.

What if I am assigned?

This is a real world possibility, and it just means I must make good on my word to buy some shares of the SPLG S&P500 fund. I will make sure that any contracts I make fall within the limits of how much money I have available. Technically because I put all the cash into SGOV, I have a near $0 amount of cash available, however, the beauty of that ETF is that it can be sold instantly on the day you wish, and you still get to keep the earned interest up to that day of the month. One doesn’t have to sell all of it, and can only sell a part of it if need be, enough to cover the need to buy some shares if that day ever comes.

There will be more to this strategy, as I still have to explain the “short side”, the other wing of the Dragon. For now, the Dragons Eye is just getting formed, and it’s focus is on a balanced, long term income fund that should be able to earn an annual rate of 15%. This is also aimed at being a fund that doesn’t require a lot of maintenance, or daily monitoring. It is not an aggressive fund, so any crazy outsized returns should not be expected. Losses need to be considered as possible, as a market downturn will put pressure on the strategy, however, the interest earned by the base is designed to help offset the downside possibilities.

Explanation of how SGOV works.

Key Characteristics:

Distributions: SGOV pays monthly distributions to its investors.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"