June 10th, 2025 – AMZN

I am pretty sure I will have two options assigned on my this week. One is a short CALL option at $210, which means I will be “Called” on an option assignment whereby 100 shares are sold at the contract price.

The other assignment is a short PUT contract I setup at $220. I am pretty sure 100 shares will be assigned to me at that price.

I am not concerned about it though, because what I focus on in option trading is the net result to the cash balance of my account. With these two option assignments, there will actually be 4 line items to consider, and in the end, it’s nothing bad, and certainly nothing to be afraid of.

All the stuff in the middle I will likely roll out to other days, it all depends on where the price settles on Friday. The focus of this post is just what to do with the $220PUT and the $210CALL

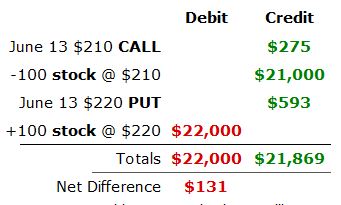

Here is an explanation of these 4 line items.

- The June 13th call was sold for $275, since I am letting it assign, then this credit is money I keep.

- The -100 stock is because I am allowing the contract to take those shares away at $210, creating another credit to the account of $21,000.

- A few days back, I had anticipated being pressured to sell this block of shares, so I also sold a short PUT above the current price as a bit of a bullish hedge. This credit will also be mine to keep because I plan on letting the contract sell me 100 shares at $220 on Friday.

- The last leg of this set of transactions that will happen is being “assigned” the shares because of the short PUT contract. This will cost $22,000.

In the end, the net difference in cash on hand will be a cost of $131 to basically keep the 100 shares that had a call against them, without having to roll it out over and over again.

It’s Wednesday June 11th, 2pm eastern time right now, and with the AMZN price at $213.58, really anything can happen so there is still time for this to sway in either direction. I will come back to this Thursday and/or Friday to explain how it turned out.

THURSDAY JUNE 12th UPDATE

With a bit of a meltdown on Weds, there may be some doubt that the $210 Call will threaten. If it doesn’t, then I will just roll the entire ball of options forward and continue with the focus on harvesting extrinsic value alone.

FRIDAY JUNE 13th UPDATE

There was some pretty significant macro-news on Thursday evening with Israel attacking Iran. This created a large amount of havoc in the after hours trading. I was sitting in my car outside work waiting for my wife when I just thought I would check the A.H. activity, and I saw the huge drop in absolutely everything. I decided to use this as an entry point to complete the last two segments of the 7 position slinky setup. I bought in at $210.25 and also $207.21. The second trade was actually a bit of a fat fingered mistake. I was trying to buy, but actually made a “Sell” order, and it executed right away. Realizing this I immediately followed it up with a buy order to not only buy those back, but also 100 more. Later I just shuffled it in with the accounting, and cycled a lot of shares out to make room for the 300 new shares bought.

At the end of it all, I just closed and rolled the active contracts for the day to appropriate future dates, and setup for the coming week.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an …

<a href="https://www.optionslinky.com/amzn-week-32/"

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on …

<a href="https://www.optionslinky.com/amzn-week-12/"

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago …

<a href="https://www.optionslinky.com/amzn-week-7/"