Today I felt it was time to take an opening position on AAPL, Apple Inc. My reasoning on this is that I feel the price has been stuck in a range where I think it will either hold, or turn slightly positive in the coming weeks.

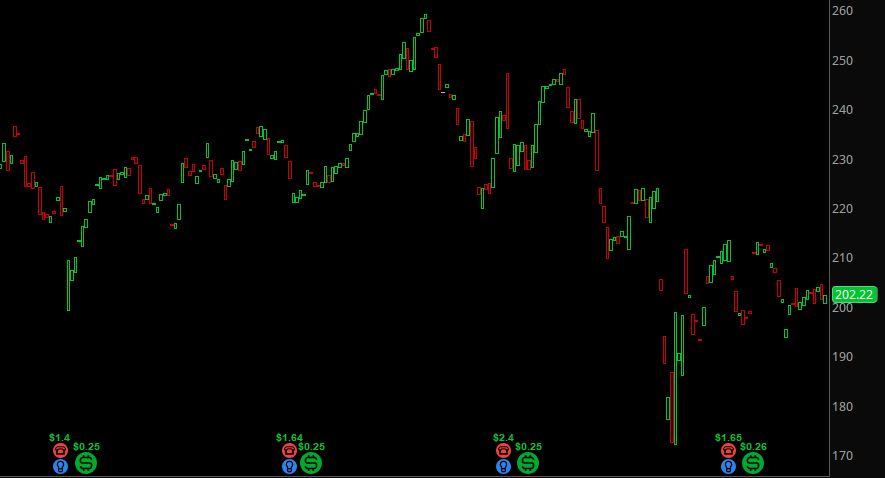

Here is a 1 year chart. Today, June 10th, Apple opened up a bit soft after some wishy-washy news. I still think $200 is a bit of a floor, so what I did was sell 2 PUT contracts. One for 3 days from now, and one for next Friday.

Additionally, to setup a small strangle, I sold a $210 CALL for this Friday as well. I don’t think it will threaten to go above $210, but one never knows.

RISK LEVELS

The risks to the downside would be having to buy 200 shares of APPL at a price of $200. So this would be a total of $40,000 of risk in the sense of having to actually invest this amount.

To the upside, 1 short call is risking being “short” the stock at $210. I leave it naked because I truly believe that is not possible this week. If it does happen, I will just swing it forward, and also roll forward short puts to balance it.

The reason I don’t think the upside is much of a worry is the current political climate. There are all sorts of issues taking place, and as long as the current president is in office, I am 100% sure the opposition will continue to do everything in their power to thwart any plans he has to make anything work. It’s just how it is in the USA, and has always been like that. Somehow despite these bi-polar issues with a two party system, the US companies always find a way to succeed however, so I think it’s wise to always point to a net “long” or bullish horizon.

Milestone Dec31

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several