June 15, 2025 – Amazon Update

AMZN finished the week like everything else in the market this week. On a dip. With worries about war in the middle east, Friday just couldn’t shake off the jitters, and thinks ended down. I won’t say sharply down, but it wasn’t pretty in the post market on Thursday, and Friday morning in the premarket things were still pretty ugly.

With inflation numbers and consumer sentiment data coming in favorable, I think that tempered what could have been a full scale sell off.

Last week our AMZN position was faring pretty well against the typical buy and hold strategy. This week things could start to get interesting for me though. I decided to take the opportunity and complete the other positions of the slinky. That meant having to push in some more capital to the original investment in order to hold 7 lots. When starting a slinky, 7 is the goal. It gives us a perfect 777 setup to work with. 7 Contracts, 7 weeks, and 700 shares. I tend to overlay extra positions once I get things rolling, but that is the basic slinky setup.

Last week our AMZN position was faring pretty well against the typical buy and hold strategy. This week things could start to get interesting for me though. I decided to take the opportunity and complete the other positions of the slinky. That meant having to push in some more capital to the original investment in order to hold 7 lots. When starting a slinky, 7 is the goal. It gives us a perfect 777 setup to work with. 7 Contracts, 7 weeks, and 700 shares. I tend to overlay extra positions once I get things rolling, but that is the basic slinky setup.

WEEK 6 PREVIEW

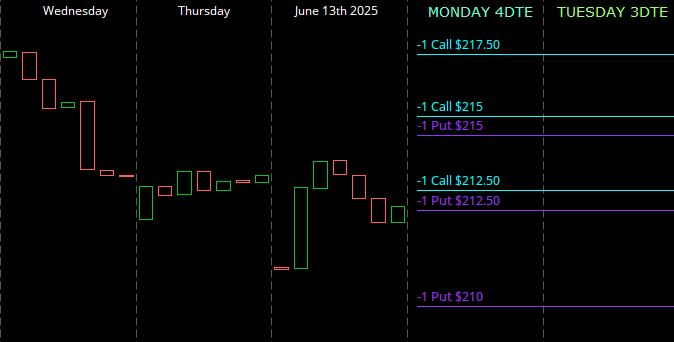

I have decided to keep a couple of the rolling options tight and close because I have no idea what direction things are heading for the June 16th to 20th week. Things flopped hard from the highs on Wednesday last week and so the setup going into next week could be too low, too high, or maybe it will be just right.

Like my old friend Kenny says, “Take what the market will give you” and that’s all we can do.

Three of these positions have what I call “Baggage” coming into the week. What I mean by that is they have some previous debit costs to them because they had been the result of a rolled option. I will explain below a couple of the moves setting up this week.

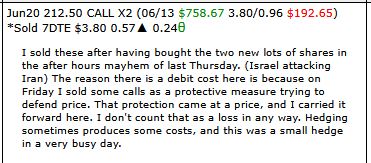

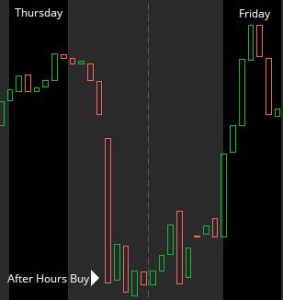

First up there are 2 short call options sitting at 212.50. It’s carrying a pretty decent credit, but the reason this position is interesting is because of why I placed it. On Thursday afternoon, well after the market had closed, I got an alert because of a very sharp drop in everything. I looked for news on why there was such a drop, and the only thing I could find was gossip on Reddit about Israel attacking Iran. I bought a couple lots of shares near the low with the intention of hedging them Friday if possible with some extra calls.

Here is a graphical look at what that was like. Naturally you can see how it might be a bit urgent/important to safeguard this new purchase.

Here is a graphical look at what that was like. Naturally you can see how it might be a bit urgent/important to safeguard this new purchase.

When the price surged upwards, this gave me the opportunity to put a hedge on. The funny thing is, it kept surging, and I felt like the right thing to do would be to push that to Jun20th, and let it play out there.

The other journal note worth mentioning is the short put that is setup for the exact same strike price as the aforementioned call. This is just a single though, and the short calls are a double. This one has it’s own little interesting history, read it below the image.

Once upon a time, there was a short put contract sitting at Jun20th. I was moved to push that contract straight upwards because of price action I had seen on June 9th. It could turn out that I am wrong on that, but something is for sure. One of these two positions I have just explained will be a winner, and one will be a loser. I may be fortunate enough to find a way to make them both winners, but I can guarantee you this, they both hedge each other, so there’s no way they both can lose.

I like these setups, always something comical that comes out of nowhere at me, and makes me smile.

That’s about it for the week. The other positions will be adapted to whatever happens, and no matter what that is, I will just keep finding ways to grind it out.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an …

<a href="https://www.optionslinky.com/amzn-week-32/"

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on …

<a href="https://www.optionslinky.com/amzn-week-12/"

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago …

<a href="https://www.optionslinky.com/amzn-week-7/"