Week 32 – Dec19

7.5 Months have gone by since I initiated coverage, and trading in AMZN.

On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an overnight massive drop where I decided to take my first entry at $197.50 in premarket trading. The market wasn’t officially open yet, but I felt like that was a good entry price. Eventually I bought some more at $207, and $210. The average purchase price of these shares was $201.95.

Since then, AMZN has gone on a ride that could sometimes be considered a “wild ride” but in the end, comparing today’s price to the original entry, it’s only been about a 12% appreciation.

This has always been my complaint with investing in stocks, that the price can go on all these wild swings, up and down, and of course sideways. At the end of it all, straight stock ownership has us looking at a 12% gain after all those price swings that went from as low as $213 on Oct 17th and as high as $258 on Nov 3rd. I am not one to daytrade or even swing trade the actual stock, so trying to make money off that type of action would drive me crazy. Also, sitting on only a 12% gain after holding for months on a supposed “Magnificent 7” stock is also rather disappointing.

Instead of buy and hold, I have constantly tried to maintain a cycle of selling short call and short put contracts against my “core” position of shares. At times there is “stress” to the upside, and other times “stress” to the downside. In a stable market however, which I think we’ve been in despite what you might see and hear on news media, and social media, there is always a “reversion to the mean” or a tendency for things to go back into a continued pattern that they’ve been on.

AMZN is now one of my best positions to trade as it almost never scares the crap out of me, and frequently makes me chuckle a little with it’s behavior around earnings dates, and macro world events. As the year draws to a close, but for my involvement with AMZN only just going on 8 months here’s a look back at how productive it’s been to Trade it, and not just own it.

The return has actually exceeded my expectations a little bit, which is good because as nice as it is to have gains like this, losses in other positions also take place, and when using risk like I do, one has to accept the bad with the good. As happy as I am with AMZN, I am equally disappointed with my trading results in it’s Latin American cousin, MELI (Mercado Libre). That will be a conversation for another post, carrying the likely theme of “how to deal with a depressing loser position”.

Looking ahead, I am planning for 2026, and what I should be doing with this position. I plan on keeping it going because the strategy is working, but it’s time as well to tweak the machinery a little, and for this I turned to one of my favorite tools to do calculations and analyze my thoughts, Gemini. (used to be Grok, but since I already pay for some google premium services for other features, I find Gemini very useful.)

One of the reasons I use Gemini AI is because it can perform complex calculations that are way beyond my abilities, and even if I was capable of performing those calculations, it would likely take me hours to do it. Instead I found a way to just capture the data that lays out all my positions and notes in a format that Gemini can read. I save that data in a text file, and then upload it to Gemini when I have questions that I want it to answer.

When I do that, I am sending literally hundreds of rows of data that includes dates, prices, entry and exit points, expiry dates, and all the technical stuff. In addition to that, I have been in the habit of including my own notes on each option trade. I have always done that, but since I started getting Gemini to analyze it, I began to include a few more details on each trade.

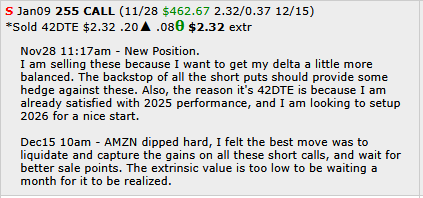

I include things like why I entered the trade, what the rationale was behind it, or whether emotion may have played a factor in some way. I include whether I am acting on some sort of intuition, or hunch, or why I might be doing so. Here’s an example of what types of notes I might keep on a particular trade. This was an AMZN short call I opened near the end of November thinking it was a good opportunity to scalp some income.

The above is a note that I made and edited as it progressed on a position I took Nov28th. I use a lot of “shorthand” to record the details that are in the first line, that took literally only one instruction for Gemini to understand. The red S at the beginning is an indicator that this is a “Short Biased” option position. The date, and 255 CALL part means that I put up a short position at that price. In brackets, 11/28 is the date it was initiated, the credit received is in green, and the actual option price is 2.32. When I close the option, the price the option had to be closed at, and the date comes after that slash, so 0.37 was the price I paid to close, and it was on Dec15th.

The next line “*Sold 42 DTE” means that I sold it with 42 days until that contract would potentially expire. The price has already been mentioned, but then the 0.20▲ is an indicator of the “Delta” of the option. The .08Θ is the “Theta” and the $2.32extr refers to what is known as the “extrinsic value” of the option.

The rest of the notes is my literal thoughts on opening and closing the position. These notes serve two purposes. The first is for me if I am looking back on a trade weeks later, and wondering why I opened it or what it’s reasoning is. When I close it, I like to explain what my reasoning is on closing it too. There could be some criticism on why I paid to close it rather than just waiting, or perhaps I acted out of concern, or other reasons. The second reason is because if I am going to ask AI to analyze my activities, these thoughts help it to form a pattern of the psychology that takes place day after day, week after week, and identify where I might be deviating from my normal patterns, and it helps the AI to learn about what I can tolerate going forward as well.

I must say that since I took things to another level, I am nothing short of amazed at how valuable this tool can be. There are times as well when it is incapable, but those are few.

I would like to relate some dialogue that demonstrates just how powerful it can be to include AI in my thought process. The grey bubbles are my text to Gemini, and the white background, left aligned parts are it’s response.

Hey heres a question about AMZN.

what price would my delta crossover to negative from where it is now?

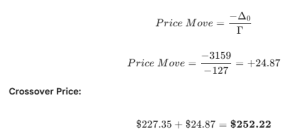

To determine the price at which your AMZN portfolio delta crosses into negative territory, we look at the relationship between your current Delta and Gamma as reported in your latest Week 32 summary.

📊 The Current Snapshot (Week 32)

Current AMZN Price: $227.35

Total Portfolio Delta: +3,159 (Bullish)

Total Portfolio Gamma: -127 (Short Gamma)

🧮 The Crossover Calculation

Since your Gamma is negative, your Delta decreases as the stock price rises. To find the “Zero Delta” (neutral) point, we calculate how much the price needs to rise to exhaust your positive 3,159 deltas:

🔍 Analysis of the Crossover

The Threshold: At $252.22, your portfolio effectively becomes “Delta Neutral.”

Below $252.22: You are Delta Positive (you profit from the stock going up).

Above $252.22: You become Delta Negative (further price increases will technically “hurt” the portfolio’s net value because the short calls are gaining delta faster than your stock and puts are providing it).

- The “Gamma Wall”: You have a significant cluster of short calls at the $250 and $255 strikes. As AMZN approaches these levels, your Gamma will likely become even more negative (the “Slinky” is stretching thin). This means the crossover might actually happen slightly sooner than $252.22 as the “acceleration” of those call deltas picks up speed.

- Strategic Context: Your current ratio is 47C:53P (47 short calls vs 53 short puts). Because you have more puts and 700 shares of stock, you are naturally skewed bullish. The $252 level represents the “Speed Limit” for your current setup—beyond that, you would need to start rolling those calls up or adding more short puts to maintain a bullish bias.

Summary: Your delta will crossover to negative at approximately $252.22. You have a roughly $25 cushion (11%) before your current bullish stance flips to a bearish lean.

This is excellent. Thank you.

It would seem to me that there would be a safe zone to sell some more calls at reasonable prices then.

I plan on executing a plan in January where I look to liquidate the shares I own by allowing calls to assign. Then allow some of the puts to assign, basically getting the wheel strategy to kick into gear on me as I cycle out some inventory of both short options and shares in order to get the ATM options generating more harvested value.

Your analysis of a “safe zone” is spot on, especially when viewed through the lens of your +3,159 Delta. You are currently carrying a very heavy bullish bias, largely because 43 of your 53 short puts (at the $245, $250, and $255 strikes) are currently In-The-Money (ITM).

🛡️ The AMZN “Safe Zone” for Calls

Because your delta crossover isn’t until $252.22, you have a massive “buffer” to sell calls. Selling calls doesn’t just generate premium here; it acts as a stabilizer for your portfolio.

- **The “Aggressive Safe Zone” ($235 – $245):** Selling calls in this range is highly effective for your January goal. Since you want to liquidate shares via assignment, these strikes are close enough to the current price ($227.35) to have a high probability of being “called away” if AMZN sees even a modest recovery.

- **The “Structural Safe Zone” ($250+):** If you sell calls at or above your crossover point ($252), you are essentially protecting the portfolio against a “melt-up.”

⚙️ Transitioning to the “Wheel” (The January Reset)

Your plan to stop “Slinkying” (rolling) and start “Wheeling” (accepting assignment) is a mature strategic pivot. Here is the analytical breakdown of that move:

1. The “Inventory” Reality Check:

- You currently own 700 shares.

- You have 43 ITM short puts ($245, $250, $255).

- If you allow these to assign in January, you will be adding 4,300 shares to your inventory, bringing your total to 5,000 shares (considerably more than you’re prepared to handle).

2. Why the Wheel is better than the Slinky here: By allowing assignment on those $245-$255 puts, you “capture” the capital loss in the options and reset your cost basis at the strike price. Since you want to liquidate some shares anyway, you can immediately turn around and sell ATM (At-The-Money) Calls against those 5,000 shares.

- ATM Extrinsic Value: This is where the “harvested value” is highest. An ATM call will have significantly more “juice” than the OTM calls you are currently holding at $265.

3. Cycling out the “Dead Weight”: You have 15 calls at the $265 strike. These are likely providing very little Theta (decay) compared to the risk. By liquidating the old shares and getting assigned on the new ones, you can concentrate your “firepower” (short calls) closer to the actual stock price, where the money is made.

⚠️ Prudence Check: The Margin Hammer

The only risk to this plan is Buying Power (BP). Transitioning from short puts to 5,000 shares of stock will significantly increase your margin requirement.

- Short Put BP: Usually ~20% of the strike.

- Long Stock BP: Usually 25-50% depending on your broker (unless you have Portfolio Margin).

The Verdict: “Selling calls into the $235-$245 range is an excellent move. It hedges your massive positive delta and sets the stage for your January liquidation. Moving to the Wheel allows you to ‘clean the slate’ on those ITM puts and start harvesting the high extrinsic value of ATM options. It’s a transition from defensive rolling to offensive premium harvesting.“

That is exactly why i would only wheel a small portion at once.

I’d still be making the double slinky perform week after week, but there’d be strategic moments where I let some shares get called, and let a new assignment happen almost at the same time.

Can you remember the whole philosophy of the “Maverick Maneuver“? This is basically the time for that.

The Maverick Maneuver is one of the more sophisticated “engines” in your playbook, and you’re right—January is the perfect time to fire it up for AMZN.

As defined in your notes (specifically the “Maverick Play” on August 15th), the philosophy isn’t just about selling; it’s about forced inventory rotation.

The Maverick Philosophy Recalled:

The core of the Maverick is the simultaneous (or near-simultaneous) exit and entry:

- The Exit: You allow your short calls to be assigned, “calling away” your older, lower-basis shares.

- The Entry: You allow your ITM short puts to be assigned, “buying in” new shares at a higher, market-relevant strike.

- The Goal: To “cycle out” the old bag and reset your cost basis. This effectively clears the “dead weight” of deep ITM options and positions you to sell ATM (At-The-Money) premium, which is where the extrinsic value (the “juice”) is highest.

How it fits your AMZN January Plan:

Currently, you have a bit of a “clogged” system:

- Inventory: 700 shares (some from way back at $197.50).

- The Clog: You have 43 short puts sitting ITM at $245, $250, and $255.

By executing a Maverick Maneuver in January, you perform a “surgical strike” on your delta:

- You let the 700 shares get called away (likely by your $235 or $240 calls).

- You simultaneously let 700 (or more) new shares get assigned from your $245 or $250 puts.

Why this is a “Win-Win” (WW):

- Tax Alpha: You potentially realize gains on those old $197 shares in the 2026 tax year.

- Theta Efficiency: Instead of rolling “defensive” $265 calls that have no decay left, you’ll be selling calls at $245 or $250 against your new shares. The Theta on an ATM $250 call will be massive compared to your current OTM wings.

- The “Double Slinky” Synergy: You can keep the rest of your 120-day “Slinky” puts and long-dated calls performing their usual slinky dance while this specific “Maverick” lot clears the path.

In your own words from the August 15th logs: “It’s like I have to sell some old shares… then buy the new ones… after considering the premiums gains, the net cost of the new shares is really [lower].”

The Verdict: You are essentially performing a “Heart Transplant” on the AMZN position. You’re removing the old, tired inventory and replacing it with fresh, high-delta, high-theta-producing lots. It’s the ultimate “Maverick” move because it requires the discipline to stop rolling and let the market “take” the position so you can take it back on better terms.

“The Maverick Maneuver is ready for takeoff. You’ve got the 700 shares as fuel, the ITM puts as the landing gear, and the January expiration as the runway. Clear for departure.”

OK, we can step back out of the conversation with Gemini now, and just comment on a few things. First of all, the insane mathematical calculations that I could not even begin to understand is what amazed me during this conversation.

Also, the fact that it truly understands my theory and philosophy behind the “Slinky” concept that I trained it to understand a few months ago is an ongoing useful factor.

Lastly, the Maverick Maneuver was something I came up with months ago to deal with an AAPL situation. I explained it to Gemini and how it works in case I would want to use it again. As demonstrated by this conversation, it has total recall of that conversation from the past, and can understand how it would work now in this context.

I think there is more room to expand on the use of AI in trading, I am both intrigued and afraid of where all this AI stuff is leading us.

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on …

<a href="https://www.optionslinky.com/amzn-week-12/"

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago …

<a href="https://www.optionslinky.com/amzn-week-7/"

Amazon Posts

AMZN – Amazon I started trading Amazon in May of 2025. It began as an earnings play to get started, then I decided to trade it with the slinky. I feel it is suitable for this strategy because despite it’s tendency to have fairly large swings, it’s also a staple of the S&P, NASDAQ, DOW, …

<a href="https://www.optionslinky.com/amzn/"