Week 12 – July 28 – Aug 1

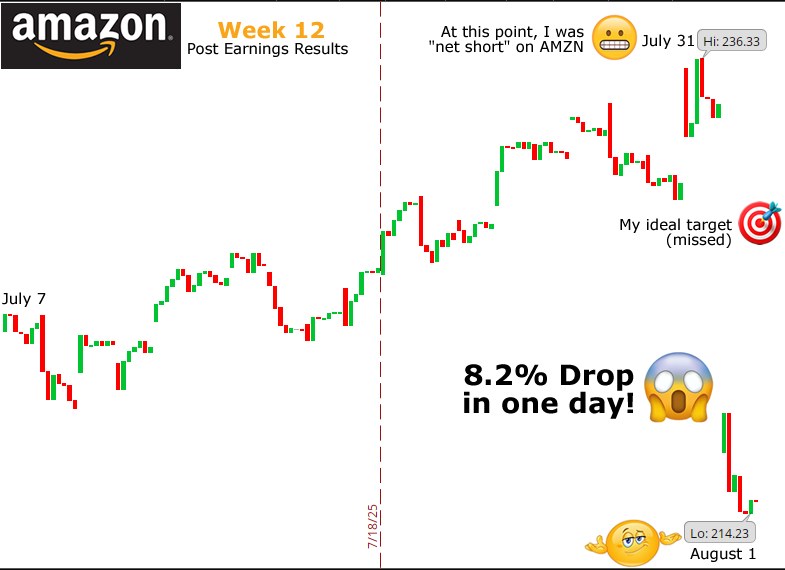

12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on Friday. Here’s a 20 day chart of how it’s been.

There is a lot to unpack in that image. A lot has been going on, and this typifies exactly why I invented the slinky strategy. For years I would always get frustrated at how I would decide on a stock, watch it go up, and be feeling good about it, only to have periods where it would flop like this, and set me back months, if not years sometimes. The strategy I follow now focuses on capturing gains when you can so that these ups and downs help rather than harm.

Why the worried 😬 emoji? At this point in time, I was actually a little bit worried because my positons with AMZN were actually in a SHORT position. This means that the more AMZN went up, I was actually losing a little each day. I held on though, because I had some post-earnings strategies ready to go if it did stay up. My ideal target price was actually just a couple $ lower than where it was on Thursday. After Hours on July 31 however, AMZN somehow shocked the market, and people went running for the exits. My short position suddenly converted back into a long position because of the swoop, and with the -8% drop that day I was able to capture some gains on all of the short positions that were previously in trouble. Some of them became almost 100% gains overnight.

It’s not all rosy however, the long side got hammered, so any positions that were present on the long side got punished hard. Rather than panic though, I view those as if they were simply long positions like simply owning the stock. They become part of “The Bag” and we look at it as if I will be “holding the bag” on AMZN for a while on those positions.

Here’s a look at how things are working out after 90 days, comparing the simply “buy and hold” versus owning and trading.

The above graphic is a comparison of buying AMZN and just holding since it was $205 versus actively trading it while also owning it. The 30.56% is down from where it was last week at 36.2% but still well ahead of the basic “buy and hold” method.

August is supposed to be a down month according to all the talking heads, so if they’re right we could be in for some headwinds in the next few weeks. I will do my best to weather the storm on AMZN, and report back as soon as possible.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an …

<a href="https://www.optionslinky.com/amzn-week-32/"

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago …

<a href="https://www.optionslinky.com/amzn-week-7/"

Amazon Posts

AMZN – Amazon I started trading Amazon in May of 2025. It began as an earnings play to get started, then I decided to trade it with the slinky. I feel it is suitable for this strategy because despite it’s tendency to have fairly large swings, it’s also a staple of the S&P, NASDAQ, DOW, …

<a href="https://www.optionslinky.com/amzn/"