June 14th, 2025

Realized Gains: $824

Overall Position PnL: -0.5%

June10 Price: $201

Sentiment: Somewhat bullish

This is my first week tackling AAPL directly. I began the position on June 10th, taking a bullish attitude. After one week, I am starting out a little bit to the downside. I don’t think it helped that Israel began dropping bombs on Iran Thursday night, and of course everything in the markets tanked very hard in the A.H. session and premarket to setup Friday.

Ironically, AAPL actually started Friday against the grain, and surged at the open. Then, it went against everybody else as well, and then tanked a bit through the day.

This would be a good time to demonstrate how every entry should be journaled. Some don’t need a ton of detail, but they should at least have the numerical things. Adding some context helps when continue analysis of the position is needed. Here are some journal entries showing how some of the AAPL positions are going to start out. I will explain below each one some rationale, and the reasons for the decisions.

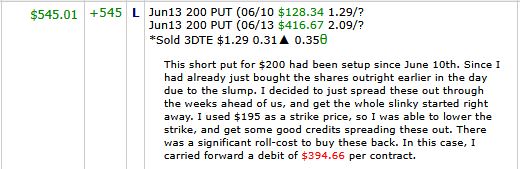

In the first column, the green numbers are the credit received for entering into the contract. This was a single short PUT contract. On June 13th during the dip, I added two more because I felt like Friday was a good day to jump start the whole slinky. As time rolled on, it became evident that this may not have been the best target price enter with, as prices dipped to below $196 at one point. I had decided instead to buy the shares there, and then roll these contracts out just to get the whole slinky strategy going. I ended up paying $394.66 per contract to roll them forward. This seems like a lot, but when you consider I got credits on the new positions for an average of $944 each it’s not so bad. For those future contracts to be considered a “win” though, I have to consider the handicap they started out with.

You can see in this snippet of my journal that I keep a bit of ordered text just to identify what it is, when opened, etc. As we look at more of these, I will explain other constant details.

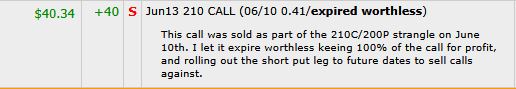

This little one almost looks a bit absurd against the others, however I always say that every bit counts, and it’s better to have a small win than nothing, and certainly better than a loss. This position is the other half of the “naked strangle” that was sold on June 10th. One side won, this one, and the other side lost and gets pushed out for credit to keep working. The words “expired worthless” are an option sellers dream come true. This means that the option only has a credit, and had no cost to close because it was OTM, or Out of The Money.

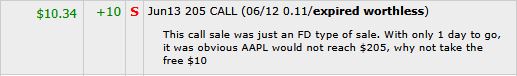

Here is another super small contract. This one was sold because I already knew things were tilting to the other side, and there was no way the price was going to surge to the upside. Despite it being Thursday at the time, I was pretty certain that we would not see +$205 on Friday, yet someone was willing to pay $10 for the other side of that. I decided to take it, and in the unlikely event that there was a big boost, I would enjoy that too. So this one was an easy $10, who says there’s no free lunch.

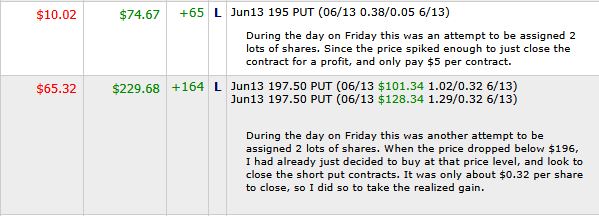

Here are two trades that took place on Friday. These are trades that I was testing the conditions on. I was interested in buying my lots of shares for the slinky at $197.50 or $195 so early in the morning I entered a couple of contracts. Each of these was for 2 contracts. The lower one, the $195 actually produced an actionable trade very early, so I paid $10 just to close it, and capture $65. I did that because this particular trade could have only ever won $10 more. At that point it just makes sense to rake it in, and move on.

On the second one, since the strike price was higher. See how it says that the put was $197.50? This is the contract price. At one point on Friday, things actually looked like they were going to shake off the WW3 worries, and prices began to rise nicely. I felt like paying $65 to bank $164 was not a bad day trade, so I took it.

These few day trades, and the credits banked from the other contracts helped to at least log a few realized gains for the first week. The overall position is down 0.5% after a week, but I find that acceptable for now. Depending on where world tensions lead us next week, it could be a lot worse, so it’s time to buckle up, and see if we can grind out some gains on this one even if it’s going to suffer for a while first.

I have the slinky setup for several weeks forward from here, but I didn’t want to create a mega post while I am just getting started. As time goes on, I will try to come up with ways to display the whole slinky so it appears ok in both mobile and desktop screens.

Mercado Libre

Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI …

<a href="https://www.optionslinky.com/meli-dec12/"

UNH Week 11

United Heath Group Week 11 – September 12, 2025 There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in …

<a href="https://www.optionslinky.com/unh-week11/"

AAPL Week 11

Week 11 – August 22, 2025 What a spectacular time to be trading. There is a lot to learn from what goes on in this time period, and it’s never boring. I put up a 30 day chart for Apple just to show all that’s happened in the last month. At the onset of August …

<a href="https://www.optionslinky.com/aapl-week-11/"