June 20th, 2025

Realized Gains: $1,807

Overall Position PnL: +3.1%

June20 Close: $201

Sentiment: Bullish

Week 2 has been a decent week for AAPL trades. There were some dips and a late Friday recovery back to the price that I first was attracted to engage with Apple. Now with a buy and hold strategy, that would mean we’re back to even. However, with the slinky approach, I didn’t actually buy until June 11th, and only 1/7th of the position size. Then on June 13th, I added the other 6/7ths of the position. Why 7ths? This is because the slinky operates on a premise of focusing on a time period of about 7 weeks, and rolling options against 7 positions through time.

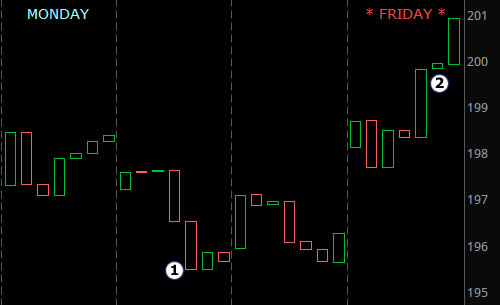

This week, June 16th to 20th had one day off on Thursday, but the other 4 days had some action, and what I felt to be a good chance to take advantage of some positions. Here’s the chart, followed by some explanations of those key points in time to make some moves.

- On Tuesday there was a pretty good dip in the price of Apple, I saw this as a good time to sell some single PUT contracts at different prices. I picked $195, and $192.50. I already had a short PUT for Friday at $200, and mid week, it was looking kind of bleak. I felt that it should be safe to “grind” out another couple positions, mostly because I also had a few short calls positions that had carried over from last week at $200, $202.50 and $205 and they were likely going to be closeable for very little cost. I actually closed them Weds because it was so cheap to do so.

- The other key moment was Friday from around 1:30pm eastern onward when AAPL took a nice little trip upward. This allowed me to cash out on the short PUTs that were taken on earlier in the week, and all targets ended up being profitable because the price went over $200, eventually up to $201.

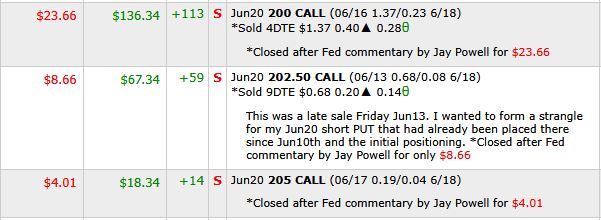

Here are a few log notes to explain rationale behind some of the moves.

These three entries are all SHORT CALLS which means they were SHORT positions against my AAPL shares. They are three different strikes, $200, $202.50, and $205. All three were closed for gains of $113, $59, and $14, a total of about $186. These aren’t big numbers, but the idea is to setup a pattern of constantly dripping gains into the overall position. The reason I closed all three of these is because right after the speech by Jerome Powell, things stayed in the dump a little for AAPL, and I thought I might as well pay to close three contracts because there was only a possibility of gaining $36.33 more if I waited for Friday. I weigh that against the risk that AAPL could pump on Friday, and I feel it’s a good time to pay that amount instead and close these three short positions while they were still in a profit position.

Next: How did the SHORT PUTs do?

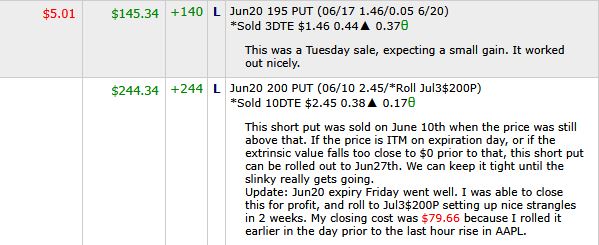

Both SHORT PUT contracts did pretty good. I didn’t include the $192.50 short put, that one closed early as well for a little gain, but these ones are worthy of some explanation.

First of all the $195 SHORT PUT. This one I left until maturity on Friday, and had an order to close it for $0.05 since inception. At one point during the day, the price was finally high enough, long enough, for the market to realize we probably are staying above $195, and so the order executed and closed for $5.01. On this day, I didn’t want to just wait it out to close at $0.01, and honestly, Friday was about removing risk as soon and as logically as possible.

The other position, the $200 SHORT PUT was one that looked like it was in trouble all week, and it could have been, if not for a late day surge. I made the decision to roll this one out to July 3rd. Because it was a bit earlier in the day that I did the roll, I paid $79.66 to close this contract. The reason I didn’t post that cost here is the same as the call above. I want to track that payment with the new move, and make sure it becomes a real payoff.

This is building up to something, and as I am writing this after the big news has already come out, you probably already know about the rockets red glare, bombs bursting in air and all that. What will that mean for all this?

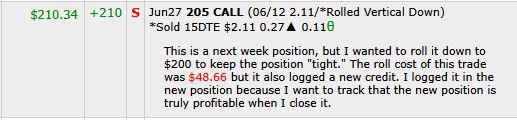

The move logged here was actually on Weds when things were down a bit for AAPL. I looked at a SHORT CALL next week on Jun27th for AAPL, and decided to lower it’s strike to $200 instead of the $205 where it was. This is a move that is defined as BEARISH because I am actually pushing down on the AAPL price with that move. I logged the $48.66 cost with the new lower priced SHORT CALL because that’s the aggression part of the move.

Now, the week wasn’t 100% roses and wins, I had one position I had to roll out of, but I saved it for last because I think it may actually work out.

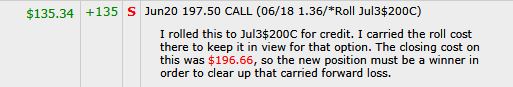

This SHORT CALL was breached on Friday when the price went above $197.50. I originally set this short call on Weds, motivated a little bit by the pessimism that AAPL would not finish well this week. It wasn’t a huge credit, only $135.34, but I had to pay $196.66 to close it and move it to a new space in time. This is technically a loss in the eyes of the brokerage, and the tax man. However, for me, I view the whole thing as “continuance” and so I rolled it to another SHORT CALL for July 3 $200, for a credit. I am almost wishing I kept the strike at $197.50 and only rolled to next week. Why?

We all know by now that bombs were dropped on Iran on Saturday June 21st. What effect this will have on markets next week all depends on how the events unfold going forward. What sort of reactions Iran will have, what other countries might do, and of course, the fear in investors will cause a significant drop on Monday, if not for the whole week.

This is where I will really find out how well things are positioned, and how to grind things out in the week ahead.

While this week was a bounce back from the end of Week 1 where I was down 0.5% to the current position , up +3.1% I think that will be short lived, and we’re in for a wild ride in the coming weeks.

No regrets. It’s time now to use all 5 qualities of the PEACH in order to navigate this safely.

Mercado Libre

Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI …

<a href="https://www.optionslinky.com/meli-dec12/"

UNH Week 11

United Heath Group Week 11 – September 12, 2025 There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in …

<a href="https://www.optionslinky.com/unh-week11/"

AAPL Week 11

Week 11 – August 22, 2025 What a spectacular time to be trading. There is a lot to learn from what goes on in this time period, and it’s never boring. I put up a 30 day chart for Apple just to show all that’s happened in the last month. At the onset of August …

<a href="https://www.optionslinky.com/aapl-week-11/"