Week 11 – August 22, 2025

What a spectacular time to be trading. There is a lot to learn from what goes on in this time period, and it’s never boring.

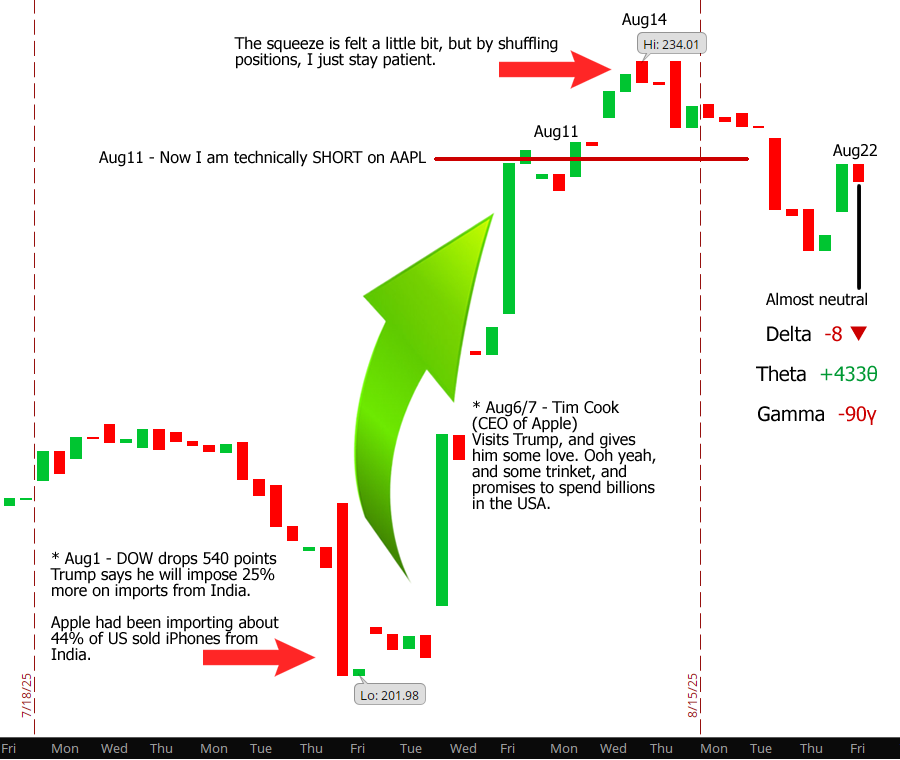

I put up a 30 day chart for Apple just to show all that’s happened in the last month. At the onset of August we see the plunge for AAPL on the tariffs planned for India.

Aug 6th – After Tim Cook went to the White House to convince Donald Trump to show him some leniency. That immediately works, and sends the stock soaring again.

Aug 11th – By this point, my strategy has now entered where I am net SHORT on AAPL. If it were to keep rising, my position would lose relative to the speed, and the incline of the rise.

Aug 14th – My short delta reached -415▼ which is sort of like being short 400 shares. The squeeze is felt a little bit, but no panic has set in yet. I just decide to hold positions, and keep rolling forward in time what I am forced to move to avoid “assignment” or having shares “called away” by short calls.

Aug 22nd – Things are back to what is referred to as “Delta Neutral.” See below the image for some explanation on this.

On August 22 there was a little rebound from the dip that was going on during the week. Most tech stocks and even regular companies were dipping pretty hard from Tuesday to Thursday.

On Friday, all eyes were on Jay Powell who has been pressured by Trump for months to lower interest rates, but he’s been resisting. There are arguments for both side of this issue. On one hand, many other countries have seen several interest rate reductions in 2025, but the USA has not. This is mainly because of fears that inflation could return to the horrible mess it was the previous 4 years when it was as high as 9% on some prints.

While he didn’t come right out and say that he would cut interest rates in September, his dovish comments indicated that he now feels that it’s almost time. That of course is well received by the market, and most stocks see a nice rebound, but basically back to where they were on Monday.

While he didn’t come right out and say that he would cut interest rates in September, his dovish comments indicated that he now feels that it’s almost time. That of course is well received by the market, and most stocks see a nice rebound, but basically back to where they were on Monday.

I have always liked Jay Powell, and his way of explaining things. It is true he is a little slow to make his moves sometimes, but that appeals to my patient attitude. I have always thought of him as a “truth teller” and that is why he is hated by Democrats and Republicans alike.

What do the Greeks Mean?

Delta ▲ or ▼ are the symbols I use for delta. Simply put, if you had 100 shares of something, you’d have 100▲ (deltas). When you sell calls against shares, there is a ▼ negative delta that would then reduce your overall bias that you have on the stock. When you have a positive delta, you benefit from the stock going up. For every $1 the stock rises, you would get $1 x your shares, or delta in appreciation. Right now the delta is close to zero, so it doesn’t have much effect on the profit or loss of these positions.

Theta Θ is the real hero of the slinky strategy. Theta is a measurement of the decay of value over time. Since part of an options value includes the value of time, allowing it to decay is a benefit to the person who has sold the option. Over time, no matter what, there will be a decaying of the value of the option. Delta can overpower theta, so if there’s a huge rise or drop, then the formula for the net change is affected in proportion. A high positive theta means gains will come daily by the decay of time.

Gamma y measures the rate of change in an option’s delta (its sensitivity to underlying price changes) for a $1 move in the underlying asset’s price, directly impacting how quickly the option’s price will accelerate its gains or losses. A high gamma means the option’s delta changes rapidly, leading to faster and more volatile price movements in the option itself, while a low gamma indicates more stable delta changes and slower price fluctuations. In this graph, a gamma of -90y means for every $1 change in stock price, my overall effect could be +/- $90.

The Theta of +433Θ overpowers this a little because it means for each day that goes by, there’s a decay in the overall position value of $433, meaning an increase in value to the position because the theta is positive.

With delta being pretty neutral, it’s not much of a factor, but if the price were to swing in any direction, then it gets plugged into the formula, and effects it’s own level of change.

Those “greeks” and how they act seems pretty complex at first, but there are ways to go about learning how they work one by one. Most people already know how Delta works, but they’ve never thought about it because they just consider the number of shares they bought as a number. Each share is 1▲ or one delta.

Theta can be compared to what happens if you sell someone a block of ice. It’s value to be sold as a block of ice has a limited lifespan, and as time goes on, it may melt away to nothing unless conditions change. With theta, when you sell an option, the value it holds is high at the beginning. As time goes by, that value can decrease to nothing, and therefore you don’t have to worry about paying anything back to close the contract. Things can change though, and that’s why delta can overpower theta if the price changes significantly. More on that another day.

How is the Slinky Strategy performing versus simple Buy and Hold on AAPL?

Since June 10 (73 days)

AAPL buy and hold = +12.4%

Slinky = +21.6

Two weeks ago, “buy and hold” was nipping at my heels on this one. The gap has widened again, and this position is up a little over 21% in about two and a half months.

Outlook going forward

If things remain stagnant for a while, my results will be best. I really have to choose now whether I think AAPL goes up from here, or down. Many of my option strangles are inverted, meaning the calls are lower values than the puts. I think I will have to use credits earned through the short put side to pay for moving the short calls to higher positions. I would have to say my inner voice says to shift to a slightly more bullish stance on this.

Mercado Libre

Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI …

<a href="https://www.optionslinky.com/meli-dec12/"

UNH Week 11

United Heath Group Week 11 – September 12, 2025 There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in …

<a href="https://www.optionslinky.com/unh-week11/"

AAPL Week 9

Week 9 – August 8 2025 This week Tim Cook visits the white house, and kisses the hand of Donald Trump. The results or reaction in AAPL stock is unmistakable a direct corelation between the visit, and the favor that Apple stock has found with investors. When I initiated coverage back in June, the price …

<a href="https://www.optionslinky.com/aapl-week-9/"