June 27, 2025 – Amazon Update

The last update for

Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago has been forgotten, and we’re in a surge that sees AMZN up 8.9% since beginning to track it 7 weeks ago in May.

![]()

The full slinky has been moving along quite nicely for two weeks, picking up some extra premium, however this week with Friday’s surge, I find myself in a Negative Delta▼ condition.

What does that mean?

This happens when the short calls that I have placed against AMZN have been passed, and now become a position that almost needs the price to go down, or stay really flat for a while in order to become profitable again. The amount of negative delta is not that much, and perhaps I can continue the rolling of options in such a manner as to pull up the short PUTs that are well below the current price, and this will add Positive Delta▲ and possibly balance the position again at delta-zero, or a little bit positive.

Let’s get to the action for Week 7 (June 23-27).

Target #1 $215 CALL

How the heck was that a winner!?! The reason this was able to come out a winner is because I closed it on Monday afternoon. At that point in time, this option only had $61 left to gain on it, since it was sold for $272 back on June 2, the passing of time (thetaΘ) had decayed this option quite nicely. I had to pay to close, but because the price was still depressed on Monday, the cost was low, and the profit was 77% or $211. In hindsight, I am sure glad I closed it early. Don’t worry though, I got myself in trouble for the July 3rd calls. That will be content for another post though.

Targets #2 & 3

I actually had 2 $215 short PUTs, but I didn’t update the number on the chart. On Friday this was possible to close easily. I could have let it expire worthless, but I did decide to pay the $0.05 to close it because of all the angst that came upon the market when Trump and Carney were having a spat.

The $212.50 PUT I actually closed one day earlier because it was sitting at 88% profitable, and only cost $18 to close one day early. I try to take those off the table early if the profit is over 80%. One never knows what can happen on expiry Fridays.

Target #4 $210 CALL

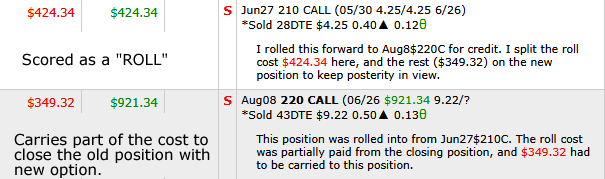

This was a tough one, but they can’t all be winners, and this one needed a roll forward. On Thursday I was forced to do something with this. The price of AMZN at the end of Thursday was pushing the cost to close this option up, and I decided to roll it up, and out (referred to as “diagonally”) to Aug 8th at a new higher strike of $220, and still pick up a net cash credit of $147. When I am scoring my wins and losses, I score this as a “roll” which is sort of like a tie with a chance to win in overtime. I will let them go to a maximum of 5 Rolls before I declare it a loss, but rarely do they get past 2 or 3 rolls before they’ve been able to turn into a winner. See some further explanation after the image.

Here is an explanation on how I account for these rolls.

The original call position was sold May 30th, so it had some credit to begin with, but rather than “decay” this option price was pushed up higher because the price took off. This creates a situation where we are happy that our stock price has gone up, we’re happy that the short PUTs we’re selling at making profits, but here’s the casualty. The short CALLS are going to be caught once in a while, and that was this week.

It’s not all bad though. We get to roll it up to a higher strike price, which means our target selling price of the 100 shares of AMZN bought back below $200, has now moved up to $220 instead of $210.

INSURANCE CONTRACT

This short call contract has now become what we could think of as a bit of an insurance contract. How so? This is because we now have a contract where someone is paying to have the right to buy those shares off me at $220, and he has until August 8th to do so.

A lot can happen between now and then, it could go up higher, it could go flat, or the price of AMZN could drop at some point as well.

This is why I don’t sweat too much when a contract like this is ITM (In The Money) and could be exercised on me.

The sweat comes when I sell too many calls against the shares, and some of those calls are naked, and also ITM. I have that happening with AMZN because I am trying to keep my delta as neutral as possible, but because am now delta negative▼, I am going to have to adjust for that to continue to be making the gains that have been happening for the past 7 weeks.

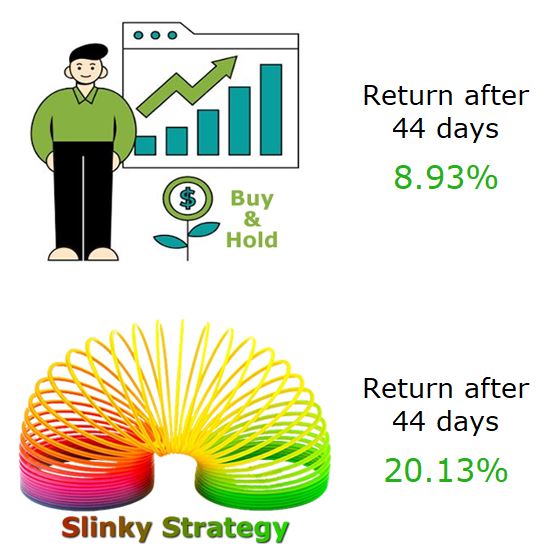

How are the overall returns going?

The returns have been pretty good considering it’s not yet been 2 months. Both a buy and hold investor and an options trader could be happy with the results after only 44 days.

Disclaimers: Results are based on a lot of hard work, and not meant to communicate that this is in any way free of risks that could blow these returns if not carefully managed. Not every single trade is outlined in order to keep the post simple, there are other trades producing income. Initial investment increased June 13th which actually handicaps and pulls back the actual return rate. I am not going to calculate a stepped ROI so I prefer to penalize the return rate percentage and actually show it lower than it truly could be.

I may not be able to report new posts because I will be taking a vacation until July 18th. I hope to be able to come back and update things when I am back.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an …

<a href="https://www.optionslinky.com/amzn-week-32/"

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on …

<a href="https://www.optionslinky.com/amzn-week-12/"

Amazon Posts

AMZN – Amazon I started trading Amazon in May of 2025. It began as an earnings play to get started, then I decided to trade it with the slinky. I feel it is suitable for this strategy because despite it’s tendency to have fairly large swings, it’s also a staple of the S&P, NASDAQ, DOW, …

<a href="https://www.optionslinky.com/amzn/"