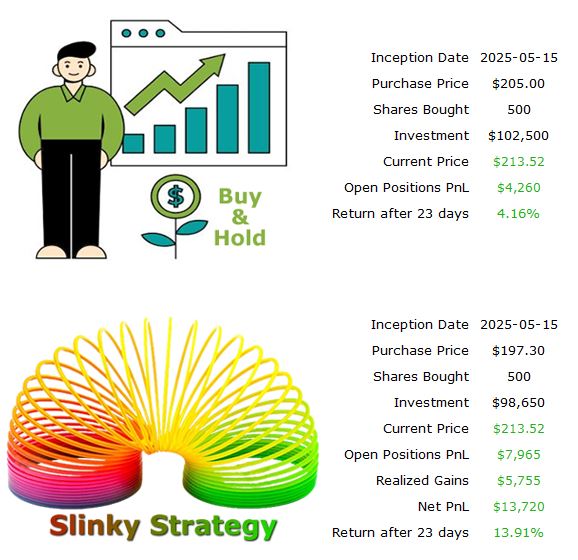

Compare Results – AMZN Week 4

June 7th, 2025

After 4 weeks here are the results so far. (From May 15th to June 6th is technically only 21 days.)

This race really doesn’t have a finish line, and there will possibly be times when the strategies can overtake each other, and one will look better than the other for a time. The idea is to always look forward, and never sit on your hands.

Most purists and those who trade stocks and options will tell you that Buy and Hold always beats trading.

Most.

Let’s acknowledge a few things because it’s not just as simple as looking at only these figures, and to do so would be over simplifying the results.

First of all, the person who buys and holds has only one risk. The amount of capital that has been put into the stock from the day they purchased it.

On the other hand, running any kind of option strategies where you have to sell short options brings in other risks. Such as:

- maybe I might have to buy some more shares because of an assigned short PUT option

- maybe I have to sell some shares because I got squeezed out of shares because of a short CALL option.

- A severe and prolonged move to upside or downside could force me to liquidate positions

Conclusion

While the 13.9% return statistic looks good, keep in mind it’s being produced by taking on risks that are outside just buying the stock.

If ever you wanted to try to mirror trades with someone, make sure you’re also willing to put in some time to get the same results. I make sure I balance the risks with probability calculations that are sometimes very calculated, and sometimes instinct moves.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an overnight massive drop where I

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on Friday. Here’s a 20 day

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago has been forgotten, and we’re