The Bag

This term can get thrown around a lot. Depending on the context, it can mean a lot of things. Often you will hear the expression “caught holding the bag” or “bagholders” when you hear people talking about stocks or investments.

A lot of the time, if you buy a stock at a given price, and it drops over time, it can feel like you’re left holding the bag.

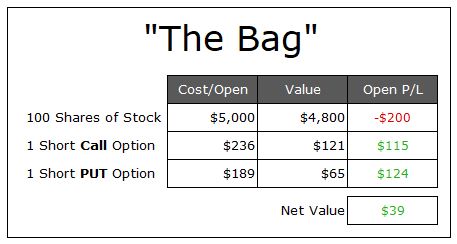

My definition of “the bag” is the grouping of any open positions including stock and options. Since either can have positive or negative values,I include them all. The collective value of all the items I refer to as “The Bag” and sometimes that can be a good thing, and other times it can feel like a bad thing.

In this case, the bag is not too heavy, in fact it looks like something that just started out. He’s down on the stock, but the option values are doing ok, so the net value of the bag in this example is $39 positive.

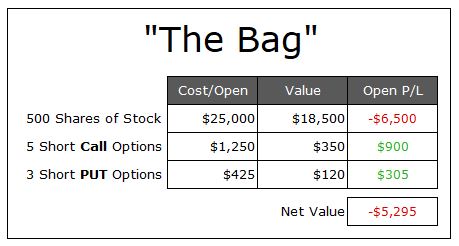

This bag is a little heavy. With a net open loss of $5,295 one might even feel like this bag is not worth holding on to, and could lead to closing out everything and walking away. If you did this, then you’re walking away with a loss of $5295 and while that may or may not be the right thing to do, it’s just defining how the open value of stocks and options can feel like you are left holding the bag while everyone else moved on to other things.

What if you had previously realized gains of over $20,000, which are not currently in “the bag” but you had closed out other positions for profit, and are just holding this part now. Having considered that, then things aren’t all that bad are they.

Another definition to consider along with the bag is “Realized Gains” That is covered in another post, just click on those words to follow the link.