Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI like I play it’s competitor to the north AMZN (Amazon) and it’s just not the same beast.

Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI like I play it’s competitor to the north AMZN (Amazon) and it’s just not the same beast.

Right now my positions on MELI are in what we call “Repair Mode” because the position is definitely broken, but I am not quite ready to just throw in the towel and quit. I have some tools in my tool kit for this situation, and while they always seem to work on other stocks that I have traded, this beast is definitely a different one to tame. I will talk a bit about my mistakes, what has led to the dire situation this stock is in. Then I will talk about how I intend to get out of it.

I have always followed this stock a little bit, not enough to say I know it like I know NVDA, AMZN, or QQQ etc, but it’s always been a stock I follow. In early August after watching a presentation by the CEO, and some talk about how Mercado Libre was running it’s business in Latin America, I decided to begin a position on it. From August 4th until about August 29th, I was just buying a few shares at a time with the proceeds I was getting from other stocks. The average cost for the first 100 shares ended up being around $2419 per share.

How I got into Trouble

Once I had this lot of shares, I decided I would apply my short strangle approach to it, and sell a call above my price, and a short put below the price level. What came shortly after was a deep surprise. On September 30th, the world fell out of love with MELI, and you can see a pretty dark crimson cascade as the price fell hard all the way down to lows of around $2018 in mid October. This is where my short put got “Assigned” to me, forcing me to buy another lot of shares at $2250 which was the contracted price.

To make things worse, I actually have some long range future contracts in February and March that actually make things even more unattractive. Is this as bad as it can get? Sadly, no. It can, and did, get much worse.

Massive Rebound – Oct30th.

Only two weeks later, there was a massive rebound, and it seemed like things might sort out again, and be back on track. There was actually a brief couple of days where I could have just closed all my positions and walked away a tiny winner, but patience won me over, and I thought I would just keep riding it out, and watching how things would go along.

By late November, things dipped even worse than before, and the hole I had dug by staying with this position became the biggest loser I have had in over 3 years.

The whole time, I have been trying to grind out little gains here and there. Some of them are actually nice little option trades, others very small wins. The point is, if all you can do is tread water, then even the dog paddle is an acceptable thing to do.

The Grind

When things aren’t going well, and I have to work a little harder on a position to eke out some gains, I call it “The Grind” and since September, it’s definitely been a grind. The bright spot is that although the real average cost of the shares purchased were $2419 and $2250 for an average cost of $2334, with all the option contract income that has been banked from week to week, this average cost has been ground down to $2067 per share. This means that if I wanted to, I could sell the shares at this price, and just barely break even.

Rather than do that though, I am employing a variant of the Slinky in order to continually grind out some gains each week, and chip away at that mountain. Each week I sell a contract that seems “just out of reach” of the current pricing in the hopes that the price might rise, but not all the way to my target. Then, the next iteration, sell another one just a few more weeks out, and maybe just a tiny bit higher, and so on. This is definitely a test of patience because the length of time between when the contract is opened, and when it expires, can often be a month. In my normal slinky setups, I aim for 7 weeks but in this particular bind I am in, I want to keep it a little closer, and since I only have two “LOTs” to sell against, I have to be careful the price doesn’t run up on me faster than I can react.

Let me show you how the contracts can work out. I have one I just closed, and another one that is going to expire on December 19th which is 10 days from now.

First lets take a look at the one that just closed, and explain how it worked out.

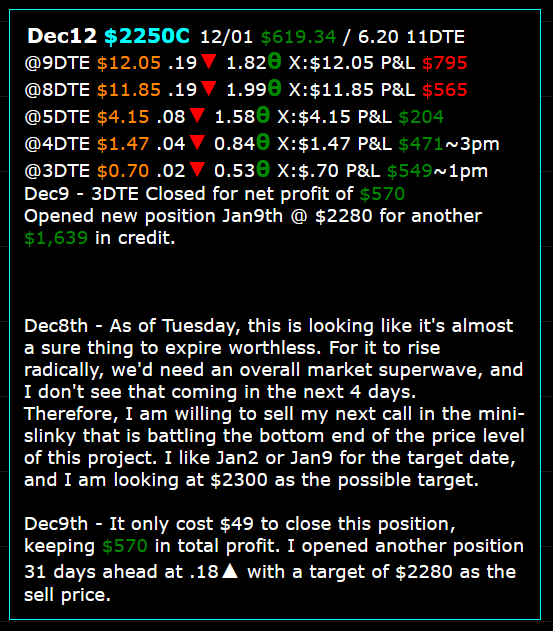

This particular contract was only sold 11 days ago on Dec 1st because I felt like a small price surge warranted adding a short term contract for a small risk, and small reward. The situation here can be explained like this; Look to the first line where you see the Date of “Dec12 $2250” – This is the expiry date of the contract, and the strike, or target price. The premium, or money received when I sold that was $619.34 or $6.20 for the contract, and 11DTE means it was 11 days until expiry.

The delta when I sold that contract was only 0.09, but it quickly went up, and against me in the first couple days of the contract period, and it looked like I was going to lose more than I even received for the contract. This is ok though, contracts often can look like this in the first couple days, and it takes some time for thetaΘ to do it’s work.

@9DTE means, when the contract was at 9 days to expiry, the stats were what you can see there. The net loss if I gave up that day would have been $795! One day later it was down to $565, and as you can see, once the weekend passed, and Monday came around, things turned into the green.

Tuesday came, and the contract is now at 3DTE, it’s only 3 days until Friday, so time is running out on this contract, and now it’s in my favor because the target price of $2250 isn’t looking very possible. The figure of .02▼ delta means that it’s pretty much got a 2/100 chance of even hitting the target. I put in a bid, and was able to buy the contract back for only $49, making this contract a $570 or 92% winner.

Now, that doesn’t sound like much, but if I can keep stringing a whole bunch of those together, when I finally do decide to sell the shares, all these little base hits add up, and while it’s not an exciting home run type of play, the grinding out of gains counts in the big scheme of things.

How about next weeks expiration for December 19th? Lets take a look at that one.

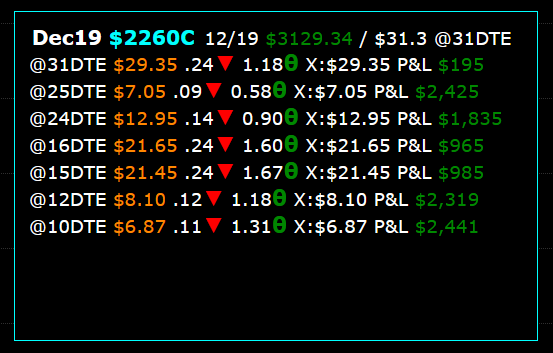

This short CALL contract was sold at 31DTE, or exactly one month from it’s expiry date. There’s still 10 days left to go, but it appears to be doing well. The target price on this contract was originally set to $2,260. If you remember, one of my “lots” of shares I was assigned at was $2,250, so if I end up having to sell the shares at $2,260, that’s a gain, and I might consider letting them go for that price just to free up some of my cash.

This contract actually jumped out to a great start, when it was only about 6 days old, there was quite a dip in the daily price of MELI, so this contract could have been closed for about $7.05 ($705.00) and the profit would have been $2,425. In the days that followed, the price for MELI bounced back up a little, and therefore the contract price also came back up with it.

Since the name of the game when you sell a CALL contract short is to buy it back as cheap as you can, I wanted to just wait. This is the hardest part when trying to be patient with short option contracts because the urge can be to jump, and close, but the opportunity to jump back on is not always there.

Fast forward to the last line, which is my note from December 9th. We’re 10 days away, and the estimated closing price for the contract is showing $6.87 or $687 total dollars. If I close it, the contract could have a total profit right now of $2,441.

When I look at the .11▼ delta though, and consider this likely is going to end up going to $0 I am more inclined to just let it decay, and wait it out for the rest of the original sale price of $3,129.

The number that says 1.31Θ is the “Theta” calculation, which means that this is calculated to lose about $1.31 per day. x100 that means that per day, if the price doesn’t jump significantly, this contract value is going to lose about $131 per day. Tomorrow that number could change, and the next day, and so on. It’s an acceleration of decay similar to how the decay of a piece of fruit that’s left out might be. At first it only rots a little at a time, but once it really starts going, you can almost watch the decay happen by the hour.

Option contracts are just like that rotting piece of fruit, and so if we have sold them, we love to see the value decay day by day. My assumption by staying in this contract is that by next week, the delta will have decayed down to .05 and the X (extrinsic value) will have come down to only a few dollars.

The only thing that would send this in the other direction is an upward price spike, which would make me happy in another way of course. So really with this contract I have two possible happy outcomes. I’d love the price to rise, just not past $2260 on Dec19th. If it’s close, then that would setup another cycle in the slinky for an even better price. The worst case scenario really is to have a price collapse further because even though that would turn this individual contract into a win, my overall holding would suffer.

I will come back and update this position next week, and see how it’s worked out.

UNH Week 11

United Heath Group Week 11 – September 12, 2025 There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in …

<a href="https://www.optionslinky.com/unh-week11/"

AAPL Week 11

Week 11 – August 22, 2025 What a spectacular time to be trading. There is a lot to learn from what goes on in this time period, and it’s never boring. I put up a 30 day chart for Apple just to show all that’s happened in the last month. At the onset of August …

<a href="https://www.optionslinky.com/aapl-week-11/"

AAPL Week 9

Week 9 – August 8 2025 This week Tim Cook visits the white house, and kisses the hand of Donald Trump. The results or reaction in AAPL stock is unmistakable a direct corelation between the visit, and the favor that Apple stock has found with investors. When I initiated coverage back in June, the price …

<a href="https://www.optionslinky.com/aapl-week-9/"