Milestone Oct17

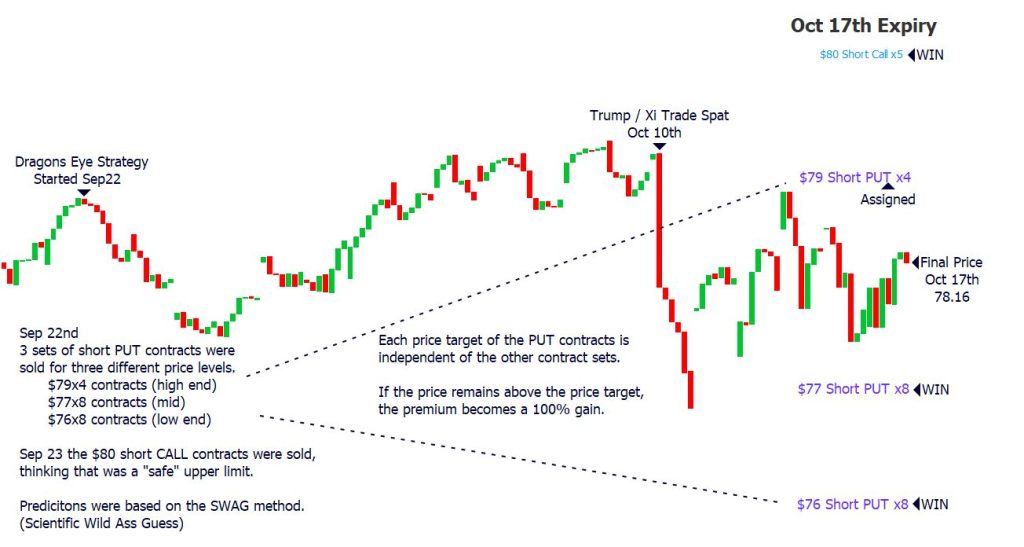

Here we are at day 27, almost a full month, and just completing the first milestone of this new strategy that began on September 21st. Things were going along perfectly for a while, until October 10th, when presidents Trump and Xi of China began to have their public spats over trade issues. Markets roiled hard for a couple days, and barely got their composure again by Friday October 17th.

First off, lets take a look at the chart and see how it went graphically over the last 27 days.

Oct 10th – Sitting Pretty Until…

The morning of Friday October 10th looked very rosy for this whole scenario, the price was sitting at about $79.12, nicely above the last $79 short put target for the month. Then, all hell broke loose in the biggest one day market drop since Trumps “Liberation Day” back in April. The day was so bad, there were not even any green bars at all after the first one of the morning, it was all red, all day. The only thing I could do that day was take advantage of the drop, and cash in on the short call positions. We will see the actual moves on those later on in the post. The weekend had to pass before any new action would unfold, and on Monday, there was a sharp bounce back after Trump basically said “just kidding” in a social media post. The entire week though would be fraught with ups and downs, and never quite making it back to where it was last Friday morning.

In the end, the entire cycle in my opinion was a net win.

- The short calls were a win. (Twice)

- $77 x 8 Short Puts were a win

- $76 x 8 Short Puts were a win

- $79 x 4 Short Puts got assigned.

I was thinking about this one Tuesday and Wednesday, and I even wrote a post specifically about whether to “Roll” this one out, or “Take Assignment” and I decided after considering some numbers that it would be ok to take assignment on this one. You can read about it here Oct17th Assignment.

The following image shows my notes along the way in this project. Remember, “DTE” means days til expiry. As it’s counting down, if things are going correctly, we should see a slow burn of theta, and a gradual growth in our positions P&L along the way. I didn’t capture all the red ink on Oct 10th because I spent a lot of my time managing the positions outside this project. Had I done so, the notes for 7DTE would have been ALL RED!

Each position has it’s label for the contracts strike price. I track the price along the way, as well as changes in delta ▲ and theta Θ so I can constantly learn from the price action of what I am trading. For the most part the moves in the theta are slow and almost non existent until the last 2 days where it jumps a bit, and we capture the last bit of profit from the options. Here’s a quick summary for each block that was planned for back in September, and how it worked out here almost 4 weeks later.

$80C x5 – I decided to close this block of short calls on October 10th after that drop, because with that sudden drop, the price on these calls became so cheap I could close it for $0.05 per contract. After commissions, and costs, this group ended with a gain of $187.

$79C x4 – Mondays bounce back was so powerful at first, that I sold another set of calls just as insurance to help out the $79×4 Short Put package that was actually under water, and in the red pretty bad at the moment. This little bounce only generated $31 in the end, but we could look at that as if it was a move that paid the commissions on this round of trading.

$79P x4 – This package had a 52.6% chance of ending up ITM, and here it is, about 80cents short of hitting it’s target. I decided it would be ok to buy these shares through “assignment” so this contract on it’s own ends up being a “win” and I end up with 400 shares at $79 each. Since the put contracts were sold at $1.38 each, the net cost of the shares is really only $77.62. Read the post on taking assignment to fully understand how that detour looks to work out. Premium captured: $549.

$77C x8 – This one would have expired worthless, but I have to admit, after what happened last Friday, I didn’t want to take a chance with this one. In the morning, it was still only at $77.45, and a small drop would have meant also being assigned 8 of these. I put an order in for $0.05 and just waited on it until I heard the chimes, and I ended up paying $40.09 to close the contracts to seal the deal into a “Sure thing.” Net profit ended up being $467 or 92.1% of the original premium.

$76C x8 – As this one was a little further away, I decided to just let it drift off into nothing. As long as the price would stay above $76, there was no risk in my mind that I would be assigned on these contracts. Net gain: $331. This is the lowest gain of all three Put Packages. The reason is, it was also the lowest risk. With lower risk, lower reward. The opposite is also true, but with higher risks, the reward is not always a sure thing.

The last part of the graphic that says “Tracking Totals” is a little thing I do on some of my positions where I put down the DTE, and how much the gains are at that point in time. Sometimes they can go backwards, as we see here happen between 9 and 3 days til expiry. In the end, the total premiums won were a tiny bit more than the initial amounts. This is only because I recycled a second round of short calls, and picked up a tiny bit of extra money on that move.

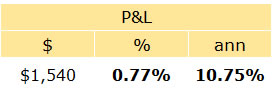

The net gain for these 27 days turned out to be +0.77% which annualized is like 10.75%. Considering it was the very first leg of the journey, and we had the big speed bump on October 10th, I will take this as a W for now, and continue on with the things I have learned.

The net gain for these 27 days turned out to be +0.77% which annualized is like 10.75%. Considering it was the very first leg of the journey, and we had the big speed bump on October 10th, I will take this as a W for now, and continue on with the things I have learned.

I did learn a few things in this first round of the Dragons Eye, and I will be making some adjustments going forward. Some of the things I have already outlined in other articles I have posted that you can link to below.

Next stop is November 21, and while all the Short Put positions were already setup, I have added one Short Call position so that I can try to unload the shares that got assigned to me on Thursday night. I raised the price from $79 to $80 because I want to also pick up some profit on this event. If Nov 21 we see the price above $80, it will be a great result for all option packages that are in place. If not, we will deal with the consequences, and make adjustments going forward.

Thank you for reading, and if you have any questions, you can ask me on the Facebook post that likely led you here.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"