October 17 Dragons Eye

Entering the Endzone

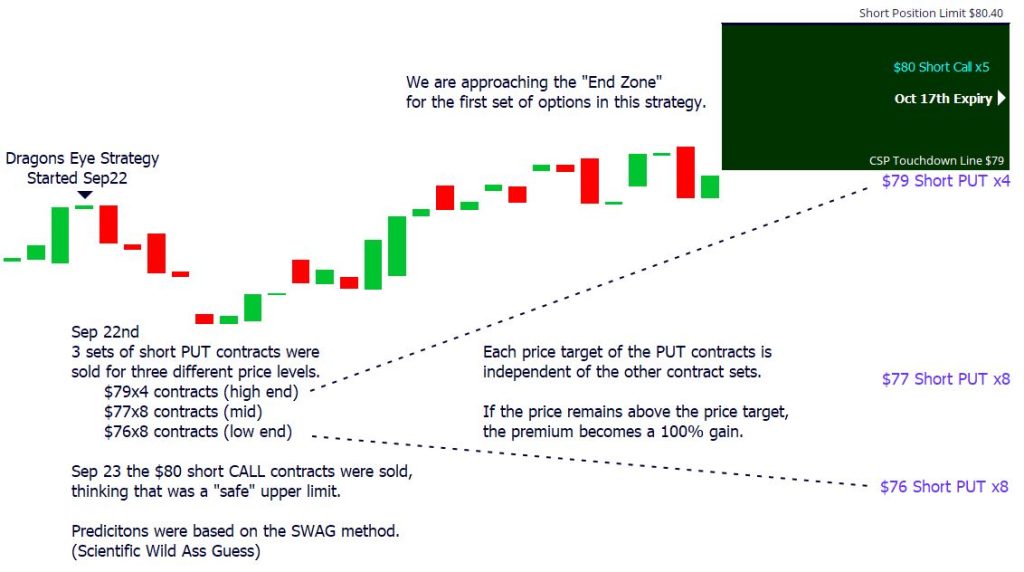

It’s Friday October 10th, the charts will say “7DTE” (Seven Days unTil Expiry) and it is looking promising for a good finish to the first milestone of expiring options.

If you’re on a mobile, you will have to zoom in and pan a bit to see all the parts of this chart. The encouraging part is that it’s approaching the “endzone” and the final expiry date of October 17th is only 7 days away, with price action being close to where predicted.

It would be nice to be able to close the contracts that are far out of the money, like the $77 and $76 contracts. The reason I don’t do so is because of the cost. 8 contracts would cost $45.20 to close even if the closing cost was only $0.05 per contract . That would be 13.6% of the premium received, and that’s too much to give up in my mind. Therefore it’s in my best interest to see if that contract can just be let to “expire worthless” which is a term music to the ears of option sellers. Another reason that it’s acceptable to have this view is because this strategy is not about “Trading Options” it’s about using them for income.

What about the $79 Short Put contract?

This one might be a contract I’d be willing to pay to close and roll because it’s close to the actual price. I have to think about this though, and not perform that move too early. Here’s why. What if the week progresses, and the price is closer to $80 than it is to $79? Then I’d end up paying two commissions to roll contracts because if I had moved early to close the $79 Short Put contracts, only to see a spike and have to pay to roll the upper end, I can look back and say I paid that commission cost for nothing.

The next 7 days will be interesting to see what price point is the focal point, and also, I need to think about where to setup new contracts. Will I be conservative, or aggressive, or a mix of the two? If you’ve been following along, I think some of you probably know the answer to that question already.

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I had anticipated, and has offered me some learning opportunities that I enjoyed. First let’s get right to the performance measure. The time period was just a little more than a …

<a href="https://www.optionslinky.com/milestone-dec31/"

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the account balance while still be able to use all of that balance for investing in other options. Part of it is comparable to what is known as an “iron butterfly” …

<a href="https://www.optionslinky.com/dragons-eye-2/"

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several supporting articles will help explain the why, when, what and how of what happens, but this document serves as the overall view in short form of the plans, methods, and …

<a href="https://www.optionslinky.com/dragons-eye-26-prospectus/"