What if Scenarios

What if this happens? What if that happens?

These are questions we should be asking prior to making any deals and selling contracts. We need to know the ramifications should the price go one way or the other, and a rough idea of how much it could gain or cost, and would there be a “Plan B” should things go against our will.

This is the whole reason I invest using options, with the methods I have worked on, there is almost always a “Plan B” and with the Dragons Eye strategy, we need to make sure we incorporate these into the overall scenario.

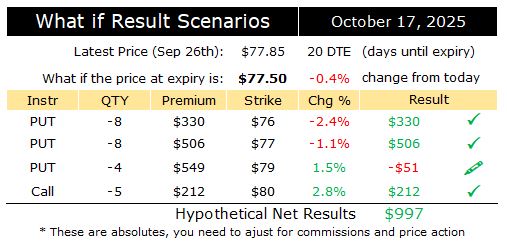

Here is a table showing the options that will expire in roughly 20 days for SPLG.

In the upper part of the table, I populated the latest price with the price from Friday.

Then I think about hypothetical prices that SPLG could be in 20 days, and just plug it in. The rest is all automatically calculated with formulas I setup. In this one, I put in $77.50 to basically say, “what if the price drops a little between now and then, what will my short options be worth at the closing date?”

The CHG% column shows you based on your hypothetical price guess what the price would have to do in order to get to each of those strikes. For example, $76 is 2.4% lower than where we are now, is that a likely scenario? Maybe, but probably not likely. How about $77? That could be possible 1.1% is not all that huge of a drop. Let’s go to the other end of the scale, $80 is 2.8% higher than where the price is today. Is a 2.8% rise in the S&P500 likely in 20 days? I didn’t think so, and that’s why I was willing to put some SHORT options on that price. It’s not a lot of income, but it’s something, and over time, these little somethings add up.

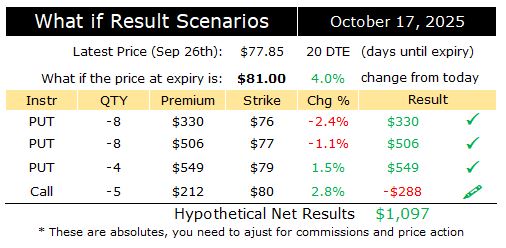

Tempting Fate – having some short calls in place also do something I like to think of as “Tempting Fate“. This is like saying, I don’t think you can get here, I dare you to. What happens if it does? Is that a good thing? People are always scared of “being short” and it’s justified, so this is why we make it a calculated risk. Let’s hypothetically say the S&P500 goes on a rip, the entire market, and it goes up 4% from today until October 17th, only 20 days away. Is that possible? Of course it is, everything is technically “possible” but what would it take to make that happen? World Peace? Change of President? Recovery from a super low? The S&P500 is at all time highs right now, 4% more in 20 days is not likely, but let’s consider what might happen if it does happen.

Here’s what happens in this scenario. If we have a price increase all the way to $81, that will mean ALL of the short put contracts will be 100% winners. The short call contract though will be in the red. Why is that? It’s $1 higher than the $80 strike price that I chose, so that means for the 5 contracts sold, it will likely cost about $1 x 5 x 100 = $500 to close those contracts. Since we had already been paid $212, this means the net debit here ends up being -$288. But look at the overall net result, it’s $1,097 which is $100 more than the previous “what if” scenario.

What do we do in these situations? Do we have to “take that loss” and feel bad about it? Absolutely not! This is an opportunity to look forward, and use it to continue the trend we wanted right from the start of the investment. When Octobers options expire, February 2026 options will likely be available, and we will look to those and open new positions there. Since all of our “winners” are now complete, we have room in our account to setup new short puts too. If the price is indeed at $81 in October, then we will be defining our outlook for 4 months ahead based on that. Maybe the highest price short put will be at $82 or $83, and the short call positions maybe we aim for higher numbers like $85 or $86. Those decisions are still 20 days away, so we don’t get worried about them now.

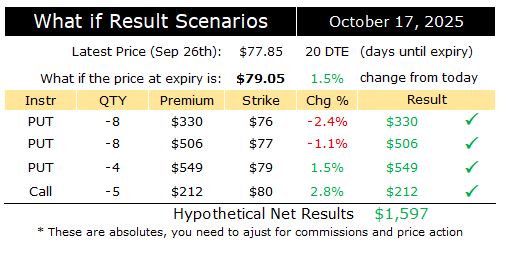

The Unicorn

Are there “perfect” ranges? YES! And sometimes they hit, and of course that puts a smile on your face, but as always, that smile last for a little bit, and you have to look ahead to what comes next. Let’s take a look at what might happen if SPLG only goes up 1.5% in the next 20 days.

Here is a table calculating what would happen if the price settles at $79.05 which is only 1.5% or $1.20 up from where we are today. Is this likely? If the market continues to go the way it is, I would say it’s possible. It’s only about 30-40% likely though. I don’t get excited, nor worried, because no matter what happens, there’s going to be a plan B to figure it out. I have ZERO DOUBT that over the next few months we will be talking about plenty of “Plan Bs” and I look forward to it because that’s what drives eventually the gains.

Be a Tweaker

It’s important to experiment in this table with all sorts of price ranges to see what could be the outcome. Tweak it and even put in the ridiculous options. What if the market drops 5%, what if it surges 5%. Those are outsized moves that stress the importance of having a diversified overall portfolio, and be invested in things that either benefit from those possibilities, or are at least benign. That’s a topic for another article, so for now I will leave you with this for now.

If you Fail to Plan, you are Planning to Fail.

Here is a link to a workbook you can open, and download so you can play with it and tweak it. There are no macros or anything dangerous in this workbook. I hope you enjoy it.

Related Posts

Milestone Dec31

Milestone Dec31 101 days into this strategy, and now it’s the end of the year. The strategy has ultimately performed a little better than I

Dragons Eye

Dragons Eye ’26 This strategy focuses on a very heavy base that is as steady as it gets with a guaranteed interest rate on the

Dragons Eye ’26 Prospectus

Dragons Eye 2026 December 2025 The following is a simplified fund prospectus. The roadmap if you will of the strategy behind the Dragons Eye. Several