United Heath Group

Week 11 – September 12, 2025

There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in trading, of course you can’t trade in reverse, so you have to make decisions before things happen and live with the consequences.

First of all, there’s a handful of things that have gone right, and a handful that went wrong. This was a tough one to navigate, and at times I felt like I was wrestling a crocodile that was frantically trying to bite me back. I want to explain some of the events, and how every single letter of the “PEACH” comes into play on this one. Probably the most, and the last, Humility, was what made me hit the eject button at the end.

This story starts long before the dates on this chart, of course this is the company whose CEO was gunned down by a deranged lunatic back on December 4th, 2024. As something that seems to be normal these days, many people cheered on this assassination, just like they have with recent events. The company has been in turmoil ever since, but I entered trading it back in May because I felt the “bottom” was probably in.

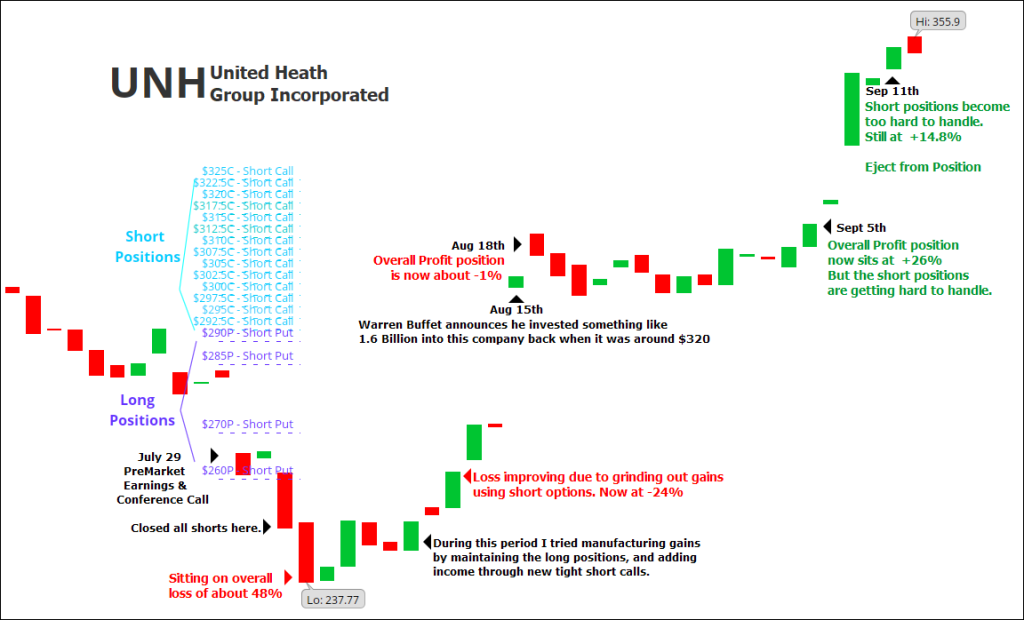

Fast forward a little to the end of July, and it’s time to report earnings. At this point in time, I didn’t feel like the company had completely recovered from their problems, and so I took a predominantly SHORT position at that time. This while also holding a small LONG position. What happened right off the bat seemed ok, all the short positions were major gains when they did announce earnings, and forecast.

However, shortly after that, the plunge kept plunging, and I found myself sitting in a position of an overall -48% loss.

(see below chart for more)

I waited patiently for a bit to see if there was going to be a bounce, and there wasn’t much, so I started to try some very “Low Risk” level short calls to try to grind out some gains while holding the long side patiently. I put that in quotes because what I did ended up not being low risk at all because of what is known as a “Positive Tail Risk” event.

For a while, I was grinding out some gains, and brought the PnL (profit and loss) up to -24%. I felt I just needed to keep grinding it out, and eventually I would be back into positive territory. Then along comes a very nice move that I wasn’t expecting.

A positive tail risk is the potential for an extremely rare and positive outcome that defies a normal bell curve distribution. This term is particularly used in the context of risk management, where a positive tail event could lead to huge positive directional moves.

On August 15th the market reacted very positively to news that Warren Buffet, the Oracle of Omaha, had invested about 1.6 Billion into UNH. This elevated the price instantly, and I was once again back to even pretty much, but now holding onto a conundrum. I had short positions with huge losses showing, and long positions that have now recovered.

I decided to try to delta balance these positions meaning adjusting to put equal weight on each side of the Short/Long spectrum. This worked pretty well until September 5th where the PnL was now up to about 26%. The underlying problem with this now however is that in taking on additional option positions to “balance” I was also taking on more risk to both upside, and downside.

On September 9th, UNH came out and reiterated some guidance that they see the next few quarters as stable, and expectations were positive, and so there was another surge to the upside.

This is when I could see I may have my hands full. I became a little unsure of what to do next, so I took a quick look at the overall position, and made the decision to pull the ejection lever, and go completely flat.

This decision was all H and a little bit of A. Remember the PEACH? Let me explain below.

P – Patience was key in even getting to the point of a recovery. I could have ejected back on August 1st when the bleeding was at -48%. Instead I studied, and decided to wait.

E – Education and knowing how to grind out gains was helpful. Correctly identifying that the volatility of UNH weekly options provides for enough premium to create income was a known. On the opposite side, I made a mistake in extending too many naked calls that I could not physically cover. A new lesson was learned this time.

A – Action was also key in two ways. In retrospect, I can see that I performed some actions that eventually were detrimental. That being taking on too many short positions during the slump that bit me in the ass when Warren Buffets involvement became evident. The positive actions to combat this were acceptable, they produced the gains from August 15th to Sept 5th.

C – Conviction kept me in the position long enough, but in the end, it may have been strong enough to also cause that drop in profits at the end. I think I could have done things differently, and this is where the H comes in.

H – Humility should have made me recognize what I was up against back in Mid August, and take the loss on the short positions then, while maintaining long positions. It’s easy to look back and identify where things could have been done differently, but I see that week as the one where I could have been a little more in tune with what was happening.

After all is said and done, I am content with this chapter of the UNH project and my involvement. 14% over 120 days in total is not my best, but certainly not my worst. I will take the small W, but more importantly, I will take the big lessons learned.

I will look to continue the adventure, as I like this company for it’s trading value. Admitting that the course I had going was becoming dangerous, and recognizing the need to eject for a few days feels right at this time.

In a couple months, there may be another tale to tell.