Week 9 – August 8 2025

This week Tim Cook visits the white house, and kisses the hand of Donald Trump. The results or reaction in AAPL stock is unmistakable a direct corelation between the visit, and the favor that Apple stock has found with investors.

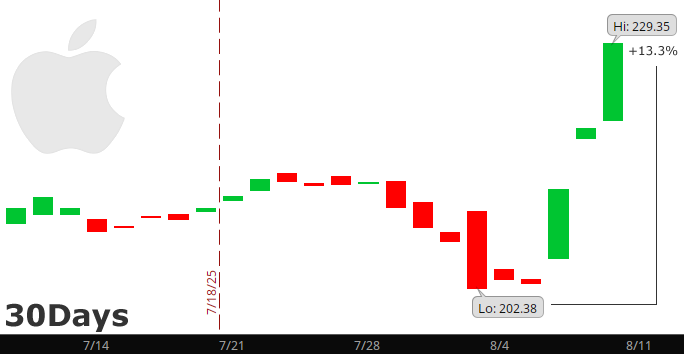

When I initiated coverage back in June, the price was hovering around $202.67. I felt it was a buy point then, and began trading. Never did I think we’d see this type of run up so quickly. Look at the chart, and the comments below.

The low on that chart was August 1st immediately following the earnings report. The price crashed the next day despite AAPL reporting some pretty good numbers actually, and positive guidance going forward.

What really sent the stock soaring was Tim Apple visiting Donald Trump on August 5th. That can be seen on the chart as the last RED bar before take off.

$600 Billion is the number that Apple committed to invest in the USA over 4 years.

Why the scared face?

I’m not really scared, but this is the typical reaction in investment forums when people talk about how the price has blown through their “short calls” and they’re now staring at huge losses on option contracts.

That’s the situation I am in now, but I am not necessarily running scared, and I will explain why. Being in a net short position allows a few luxuries that are not normally available. For example, I can now take out a few more long side moves to compensate for this, and these moves will either be rewarded with free cash, or, the price will come down again and reduce the pressure on the short side.

There’s one more move I was ready to use when AMZN was rocketing, but has since settled down so I put it away for the time being over on that project. It’s called the Maverick. If I use it here on AAPL, I will be sure to make a post about it to explain the dynamics of how it works. It’s something I designed to escape short positions with either a very small amount of damage, or an actual profit.

How is the Slinky Strategy performing versus simple Buy and Hold on AAPL?

Since June 10

AAPL buy and hold = +13.4%

Slinky = +15.4

I am barely ahead at this point because of this massive move. I will do my best in the weeks that come to see if I can overcome being short, and widen the performance gap over buy and hold.

Mercado Libre

Let me talk about one of my losers today. MELI or Mercado Libre is certainly not a loser, but I did go bullish on it at the wrong time, so for me, yeah, it’s a loser. My main problem with what I have gotten tangled up with here is that I tried to play MELI …

<a href="https://www.optionslinky.com/meli-dec12/"

UNH Week 11

United Heath Group Week 11 – September 12, 2025 There never seems to be a dull moment with this company. This blog is about knowing when to eject from the position, and why. Learning from the events, and looking back it’s easy to see where I should have done a few things differently, but in …

<a href="https://www.optionslinky.com/unh-week11/"

AAPL Week 11

Week 11 – August 22, 2025 What a spectacular time to be trading. There is a lot to learn from what goes on in this time period, and it’s never boring. I put up a 30 day chart for Apple just to show all that’s happened in the last month. At the onset of August …

<a href="https://www.optionslinky.com/aapl-week-11/"