July 23 after the market closed Elon Musk and Vaibhav Taneja (CFO) engaged in a conference call that I actually tuned in on. I don’t often do that, but I had the opportunity, and I thought it might be interesting to listen in. Elon sounded like he may have taken one too many pills, and was sort of out of it which is what we might expect from him lately. His CFO was very coherent, and agile at answering questions and delivering data. I feel they failed to impress anyone however, and it was a disappointment.

July 23 after the market closed Elon Musk and Vaibhav Taneja (CFO) engaged in a conference call that I actually tuned in on. I don’t often do that, but I had the opportunity, and I thought it might be interesting to listen in. Elon sounded like he may have taken one too many pills, and was sort of out of it which is what we might expect from him lately. His CFO was very coherent, and agile at answering questions and delivering data. I feel they failed to impress anyone however, and it was a disappointment.

At the end of it all, Wall Street was a little bit upset, and send TSLA stock plunging as much as 9.5% in after hours, and the following day.

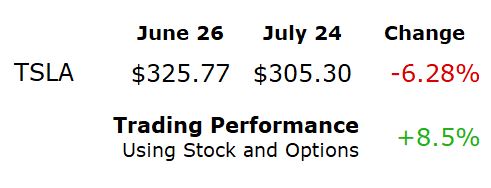

I was only expecting about a 6% swing in either direction, so my barrage of short options was not perfectly setup to capture a perfect Theta Crush day, but I am certainly not disappointed.

The chart below shows just how dramatic that drop was.

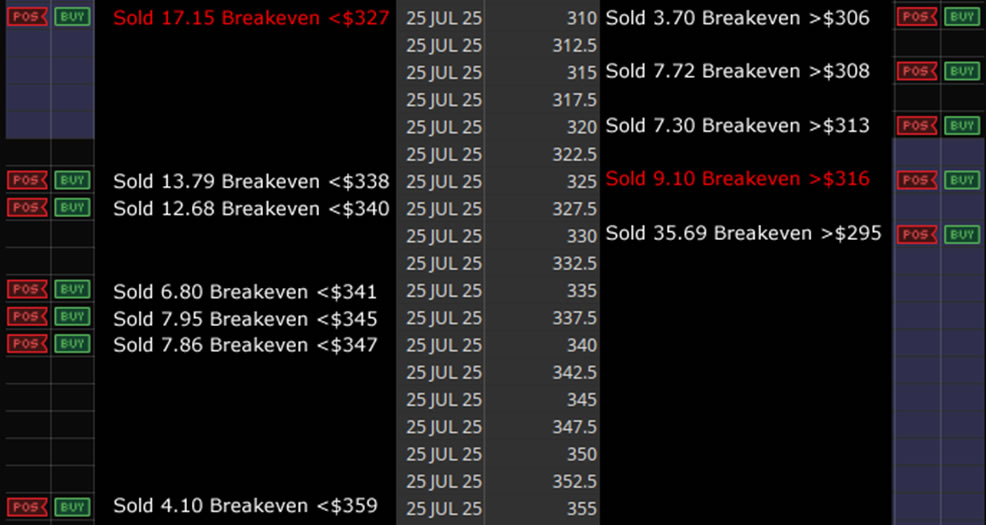

I won’t post a wall of text but I can share a screen shot of how I was setup going into the earnings period.

I outnumbered my short calls, which are “SHORT” bias positions versus the short puts which are “LONG” bias positions. So at the end of the day on July 24th, I would say the SHORTS won, and I managed to eke out a win, albeit a bit of a bloodbath.

It would likely take a live explanation in person to detail each position, and why it was taken etc. I won’t do that, but I would like to explain that some of these positions had been a “rolled into” type of position, while others, like the $355C and $310P were short sales that were placed right on the last day before the announcement. The $355C turned out to be a 98.8% Win, while I am still waiting to see if the $310 short PUTs will be salvageable by Friday at the close.

It was my first earnings week trading options on TSLA which is no excuse nor justification for results. There is still some time left on the clock, but it appears as though I should come out of this series with a win. Maybe a hard fought, bloody knuckles, broken bones and missing teeth style game 7 type of win, but I will take it.

Comparing TSLA since June 26th when I began my plays to now, here are the results.

It has been a wild ride, and especially considering that for half of the time that I have been engaged with TSLA trades I was on vacation, I think it’s working out ok so far.

This is a Dr Jekyll and Mr Hyde type of stock, so I need to have my wits about me going forward. If you listen to the fan-boys on one side, you’d think TSLA will be heading to over $2000, and if you listen to the other side, the expectation is bankruptcy in 3 quarters.

I will continue to play the volatility, and take positions that essentially fight across the price range and collect “Theta” as time expires on the clock each week.

I will update this position at 60 days, and in the meantime, possibly explain finer details about individual setups along the way. Now that earnings are out of the way for 3 months, there should be no more hiccups right? Elon and Trump should refrain from exchanging blows on their social media platforms? Not likely, I think it will be a fun ride for a while yet.

TSLA – 1 Month

After all was said and done on Friday July 25 the results so far are pretty satisfying. I knew when I started trading TSLA that it would be a dumpster fire, in fact, I posted an image on my FB account the day I began coverage and trading on it with the caption “TSLA – …

<a href="https://www.optionslinky.com/tsla-1-month/"

TSLA

Tesla as an investment is something I have always avoided. I never thought that it was worth the price, and honestly, I still don’t. I think the stock as a car maker is grossly over valued, the CEO is erratic, his political ties with Donald Trump cause nothing but mayhem, the investor base is largely …

<a href="https://www.optionslinky.com/tsla/"