June 6th, 2025 – AMZN

This blog is long, and has a lot of details including important calculations on how options decay and expire. At the end there is a link to see how we’re doing so far with this strategy compared to buy and hold.

THURSDAYS MAYHEM

That was a very interesting day. First of all, we see a surge in everything in the morning because of some decent data, and optimism. Then, Elon Musk and Donald Trump break out in a social media war we sort of knew was coming, but just didn’t know when, or exactly how.

This of course threw a mini nuclear bomb into everything and the whole market went on a downturn, and you can see it in the chart below. The black parts of the chart are the open market hours, and the grey are the after hours, and night trading available in some brokers. The symbol is SPY which is a pretty good overall gauge of market sentiment.

Normally when this sort of thing happens, it’s a cascading drop, and can be a tough circumstance to trade under.

Just prior to this whole drop, I had actually closed some of my “long biased” (bullish) positions simply because I looked at them, and some of them had reached near 90% of possible gains. When that happens, I like to make sure I capture them to protect against this very type of thing.

Some of the positions I had closed were the majority of my Short PUT options expiring June 6th for AMZN, and a couple from the June 13th series too because they’d already reached close to 80% profit with still over a week to go. While I was at it, I also liquidated a few larger bullish Short PUT positions on NVDA about 5 minutes before the peak.

After that, I said to myself, and a couple others who I share all these ramblings with “Now, it would be ideal if the market would go down.”

Why the heck would I say that? It’s because I found myself in a postion where I was almost “Net Short” on AMZN, and my positions on NVDA were also approaching “Net Neutral” so a dip would benefit the strategy overall.

Sure, the portfolio balance takes a hit for the day when we experience these sudden drops, but I don’t focus on just the net value, I focus on opportunities where you can capture gains.

Once this massive dip happened, I thought to myself, “I don’t think I should wait for jobs and unemployment data tomorrow. I think this is the dip, tomorrow is going to bounce.”

So during that deep dive yesterday, I reestablished most of the bullish positions at better prices thinking that if I wait, I will miss the bus on this, and have difficulty resetting my position.

Now, it’s not all rosy because of this bounce back. I totally was expecting a chance to sneak out of some short positions scott free, it turned out I couldn’t do that, and eventually had to work another strategy into the options that ended up being “Losers.”

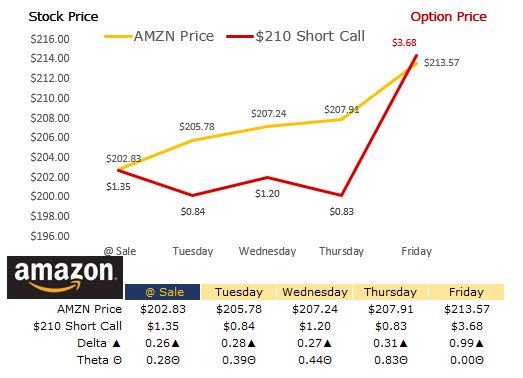

There is the week in a nutshell. From Monday to Friday things meandered along, eventually spiking on Friday a little past the targets I initially set on the upside. This created 2 losers, and 4 winners. The reason I ended up with so many short PUT contracts is because I sort of feared a crossing of the $207 line, and I wanted to make sure I could be compensated if that happened. I didn’t think the $210 CALL would be in danger, but look how it turned out.

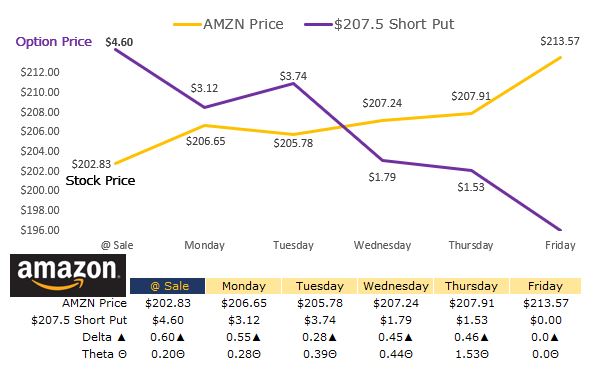

Now it’s time to explain what happens on the data level of these contracts through the week. Below I will go on to explain both an expiring PUT contract, and also the CALL contract.

All the short PUT contracts were a resounding success. The two short CALL contracts now need some work, but it’s not dismal, remember, the stock price is going up, and we like that.

SELL HIGH – BUY LOW

Everyone knows the buy low sell high idea. With selling options, it’s the reverse. First the option is sold, and later you want to buy it back cheap.

I put this in my blog yesterday getting ready to post today. Even though I exited this position yesterday at the top, I re-entered it after the whole dump that happened because I thought I could double dip.

This chart helps to see what happens in the price action to a SHORT PUT CONTRACT as time goes by, and the price stays above the target of the PUT contract. The purple line originally started at a price of $4.60, that’s what I sold the contract at on May30th. Then through this week you can see how it had a constant decline. This is what we want to see because when we buy the contact back, it will be cheaper than when we sold it.

Great right? That’s not always how it works out though. I had two options this week go against me, and they cost money to close. I will show how I dealt with those, and only time will tell if it’s the right thing or not.

A LOSING SHORT CALL

This call clearly should have been closed Thursday during the spat that was going on. Instead, I held the contract open, thinking that Friday wasn’t going to bounce back so much. Now, I need to find a way to turn this into a win somewhere down the road.

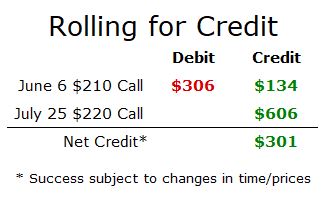

This activity is referred to as “ROLLING” because we’re going to take the present option we have, and despite it being in a losing position, we’re going to ROLL it forward in time, ideally pick up some credit money, and then see how the next iteration turns out.

Many options purists, and NPCs on reddit will tell you this is not the right thing to do. I have years of proving that wrong, and I will show the math to prove it. There is a time where it could prove to be pointless, but that happens very rarely, so I go with the percentages, and will follow my rules. There’s no panic, it’s just math.

The June 6th call was clearly a loser, and there’s no ignoring that. To continue forward though, which is the way of the slinky, we need to look out and up. I have several options I could do, but I chose this one. I reached out 7 weeks in time, looked at the call price for the July $220 Call, and noticed it’s pretty juicy. So I paid $306 to close my Jun 6th position, but immediately received $606 to open the contract for July 25th at a strike target $10 higher than it is now. I do feel good about this, since it’s aiming for continued stock appreciation, however, we should know by now, a lot can happen on the parade route.

There we have it. Week 4 has come to a close. I will say week 4 because we started this log of events back on May 15th move by move. And while technically that’s only 22 days, let’s track it in the sense that we started 4 Fridays ago.

It’s almost been a month, so it’s time to look in to compare how is this strategy doing compared to simple buy and hold.

The next post will show the differences between this powered up slinky strategy, and good old buy and hold.

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an overnight massive drop where I

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on Friday. Here’s a 20 day

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago has been forgotten, and we’re

AMZN Week 32

Week 32 – Dec19 7.5 Months have gone by since I initiated coverage, and trading in AMZN. On May 5th I took my first bullish position in AMZN aiming for purchase at $205. I can remember swapping a few options for a few weeks until there was an event induced by Trump that caused an …

<a href="https://www.optionslinky.com/amzn-week-32/"

AMZN Week 12

Week 12 – July 28 – Aug 1 12 Weeks have gone by, three months since I initiated trading in AMZN. The price when I began to look at long term trading was $205. It’s gone through some ups and downs, and most recently a huge dip from it’s high, to settle at $214.75 on …

<a href="https://www.optionslinky.com/amzn-week-12/"

AMZN Week 7

June 27, 2025 – Amazon Update The last update for Amazon was 2 weeks ago when I filled up the rest of the slinky (7 total share lots to trade on) when the entire market was taking a dip. This week the action is in stark contrast. What everyone was worried about 2 weeks ago …

<a href="https://www.optionslinky.com/amzn-week-7/"

Amazon Posts

AMZN – Amazon I started trading Amazon in May of 2025. It began as an earnings play to get started, then I decided to trade it with the slinky. I feel it is suitable for this strategy because despite it’s tendency to have fairly large swings, it’s also a staple of the S&P, NASDAQ, DOW, …

<a href="https://www.optionslinky.com/amzn/"

AMZN Week 5

June 15, 2025 – Amazon Update AMZN finished the week like everything else in the market this week. On a dip. With worries about war in the middle east, Friday just couldn’t shake off the jitters, and thinks ended down. I won’t say sharply down, but it wasn’t pretty in the post market on Thursday, …

<a href="https://www.optionslinky.com/amzn-week-5/"

Called and Assigned

June 10th, 2025 – AMZN I am pretty sure I will have two options assigned on my this week. One is a short CALL option at $210, which means I will be “Called” on an option assignment whereby 100 shares are sold at the contract price. The other assignment is a short PUT contract I …

<a href="https://www.optionslinky.com/called-and-assigned/"