Thursday June 5th 2025

We’re 1DTE from this weeks options expiries, and up until now, I have been letting them coast into Friday on the public AMZN project. Today might be different, and I will explain a few things to show you what I am thinking. Today’s actions will include a couple of my “pillars of trading strategy”

#2 Act decisively.

#4 Be humble (originally, don’t get cocky)

There should be another post to explain my 5 Pillars of trading, but for now, I will go into detail to explain these two, and how they apply to the AMZN options for this week.

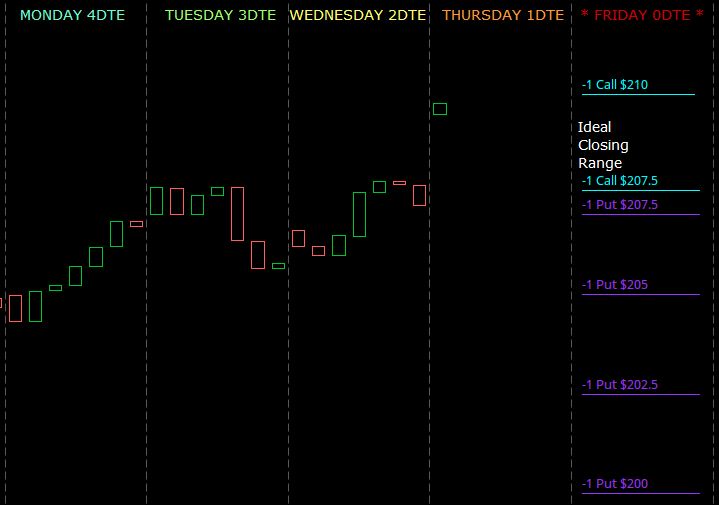

First of all, this week I did a little labelling work on one of my pop-out charts on the Think or Swim trading software provided by my broker. Here is a screen shot of how that looks.

This pop-out chart graph helps me see visually where things have been heading for the week, and begin the planning work for the end of the week. The colors of the headings (days of the week) are meant to convey some thinking. Monday is Blue because generally, things are still cool on Monday. Tuesday changes a bit, things could begin to happen, but Weds turns yellow because the “heat” could begin to show up as early as Wednesday. Thursday and Friday of course progress through warm to hot. Obviously Friday is the last chance to make some decisions because it’s 0DTE. (Zero days to expiry)

ACTION TIME

Referring to my trading rule #2, this may be a day for some action. Here’s why. Some of my short PUT options are going to be in a situation where there isn’t much upside left, and waiting until Friday could be a very naive decision because only bad things can happen from here forward. This is because some of those options are going to be more than 90% profitable, with one day left. What could happen though if Fridays macro-data on jobs comes out, and it’s disappointing, the price could plummet, and we will look back and wish we closed those options on Thursday.

OPTION VALUE DECAY

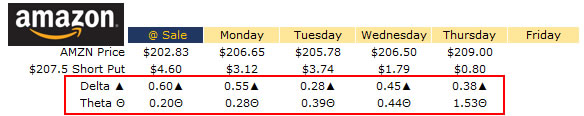

Check out this chart made in Microsoft Excel.

I made this chart in Excel to show how there is a relation between a short PUT contract, and the price of the stock. And as we approach the Friday expiry, the price of the option will lose it’s value on a short PUT the higher the stock price goes, and the closer we get to expiry.

In this chart, ideally we want to see the price of our stock which we bought to own, GO UP. That’s sort of the fundamental of buying stocks, we want them to go up. Now, this particular option we’re focusing on right now is one that benefits from a stock rise, so it’s not a hedge at all against the stock, it’s more of what they call a “Texas Hedge” which is like doubling down in one direction.

Let’s get to the decision part. If we look at the price that this option was originally sold for, $4.60 and then look at what it’s worth today, probably going to be less than $0.60 by the end of the day, I am not sure. The point is this, we have a few factors that could change the course of what looks like a win, and wipe out all those gains that this option has had.

Remember when you look at the chart, the red line, the option price, we want it to go down. The flip of the mantra “buy low – sell high” is “sell high – buy low.” Since we sold this option at a pretty high price relative to where it is today, buying it back, even with 1DTE is a WIN. I don’t always need to be waiting for an option to go to $0.01 to consider it a success. We had some fun in the last two weeks with the whole Touchdown thing, but at the end of the day, we want to make money, but reduce risk.

Tomorrow on the Economic Calendar there will be important data on Non-Farm Payrolls, and Unemployment Rate that will come out 1 hour before the market opens. No matter what those numbers are, Friday could potentially ruin some of these very solid gains.

At the bottom of that chart, you can see some odd looking data.

These are two of the “GREEKS” that I watch on my options, and the reason that the “Slinky” was originally called the “Delta-Theta Slinky”.

Obviously I am going to need to write about that to explain it some more, but just take a look for now, and notice that the “Theta” number, Θ is the greek symbol for that, has been increasing over time.